Chart of the week (14 2025)

IGC expects substantial expansion of dry pea production in Russia

The International Grains Council (IGC) expects a rise in global dry pea production for the upcoming season. Whereas Russia is projected to harvest more dry peas in 2025 than a year earlier, Canada's harvest is seen to fall short of the previous year's level.

The IGC assumes that world dry pea output will amount to 15.2 million tonnes in the 2025/26 marketing year, representing a substantial increase of 6.3 per cent over the previous season. Research by Agrarmarkt Informations-Gesellschaft (mbH) suggests that this would mark an eight-year high. The forecast is mainly based on a higher harvest estimate for Russia, where the harvest is seen to grow around 900,000 tonnes, or 23.7 per cent, year-on-year to 4.7 million tonnes. The increase is attributed to an expansion in area sown, fuelled by strong export demand. This means that Russia will remain the largest dry pea producer worldwide.

Canada ranks second with a presumed production of 2.8 million tonnes, representing a decline of 200,000 tonnes or 6.7 per cent. In other words, the historically low output of 2.2 million tonnes recorded in the 2021/22 season would be surpassed significantly. However, if the current trade uncertainties continue, Canada's dry pea area could be reduced even further, bringing the Canadian harvest down to a level significantly lower than previously expected. The reason is that China, in particular, is a crucial market for Canadian dry peas. The EU-27 follows in third place, with production projected at 2.2 million tonnes and an increase of approximately 100,000 tonnes.

The US dry pea harvest is projected to decline to 700,000 tonnes, a drop of around 100,000 tonnes from 2024. Production in India and Ukraine is seen to remain stable at 1.0 million and 0.5 million tonnes.

In view of the EU's strong demand for feed protein imports, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has once again underlined the great exploitable potential for growing dry peas and other large-grained pulses such as soybeans, peas and lupins, in Germany and across Europe. From the perspective of the UFOP, these crops are key factors in resilient crop rotations aimed at mitigating climate change. According to the UFOP, the production of protein crops in particular has numerous positive effects on the environment and agricultural soils, such as biological nitrogen fixation and the provision of feed and habitat for flower-visiting insects.

The association has called on the new German government to strengthen and provide reliable support for a comprehensive protein plant strategy that includes cultivation, product development and sales promotion to unlock this potential in Germany, adding that economic incentives are essential for encouraging crop diversification with grain legumes in the long term. The UFOP has highlighted the urgent need for research and investment in crop breeding, cultivation efficiency and development of new products both for human consumption and livestock feed.

Chart of the week (13 2025)

EU is key market for US soy

The European Union (EU) is the primary market for US soybeans, second only to China. However, the EU has announced initial retaliatory tariffs in response to US tariff policies. This move is expected to negatively impact US soybean sales.

After Brazil, the US is the world's second-largest supplier of soybeans. With national production totalling just under 119 million tonnes, approximately 50 million tonnes of US soybeans are expected to be shipped across the world's oceans in the 2024/25 season. While China is the main recipient, the European Union also imports a significant share, making it the second most important market for the US. According to data from the EU Commission, the EU purchased a total of 13.1 million tonnes of soybeans from abroad in the past crop year. Of this, approximately 5.9 million tonnes came from Brazil, while 5.3 million tonnes were sourced from the US, representing a share of nearly 41 per cent of total imports.

The picture has been slightly different in the current season. As of 16 March 2025, the EU had obtained around 9.6 million tonnes of soybeans from abroad, with the US accounting for the largest share – 5.1 million tonnes, or just over 53 per cent. Agrarmarkt Informations-Gesellschaft (mbH) has noted, however, that the Brazilian harvest did not take place until February/March 2025. This suggests that, in the coming months, soybeans will primarily be sourced from South America's 2025 harvest.

Another key factor is the EU Commission's announcement of a 25 per cent penalty tariff on US agricultural products, including soybeans, in retaliation for the additional tariffs the US imposed on steel and aluminium imports. The tariffs could take effect as of mid-April. Given the ample global supply, EU importers are likely to turn to South American soybean suppliers to meet their needs. Ukraine is also expected to move further into focus as a supplier. In this scenario, the losers would be US soybean producers as they would lose a crucial market.

Chart of the week (12 2025)

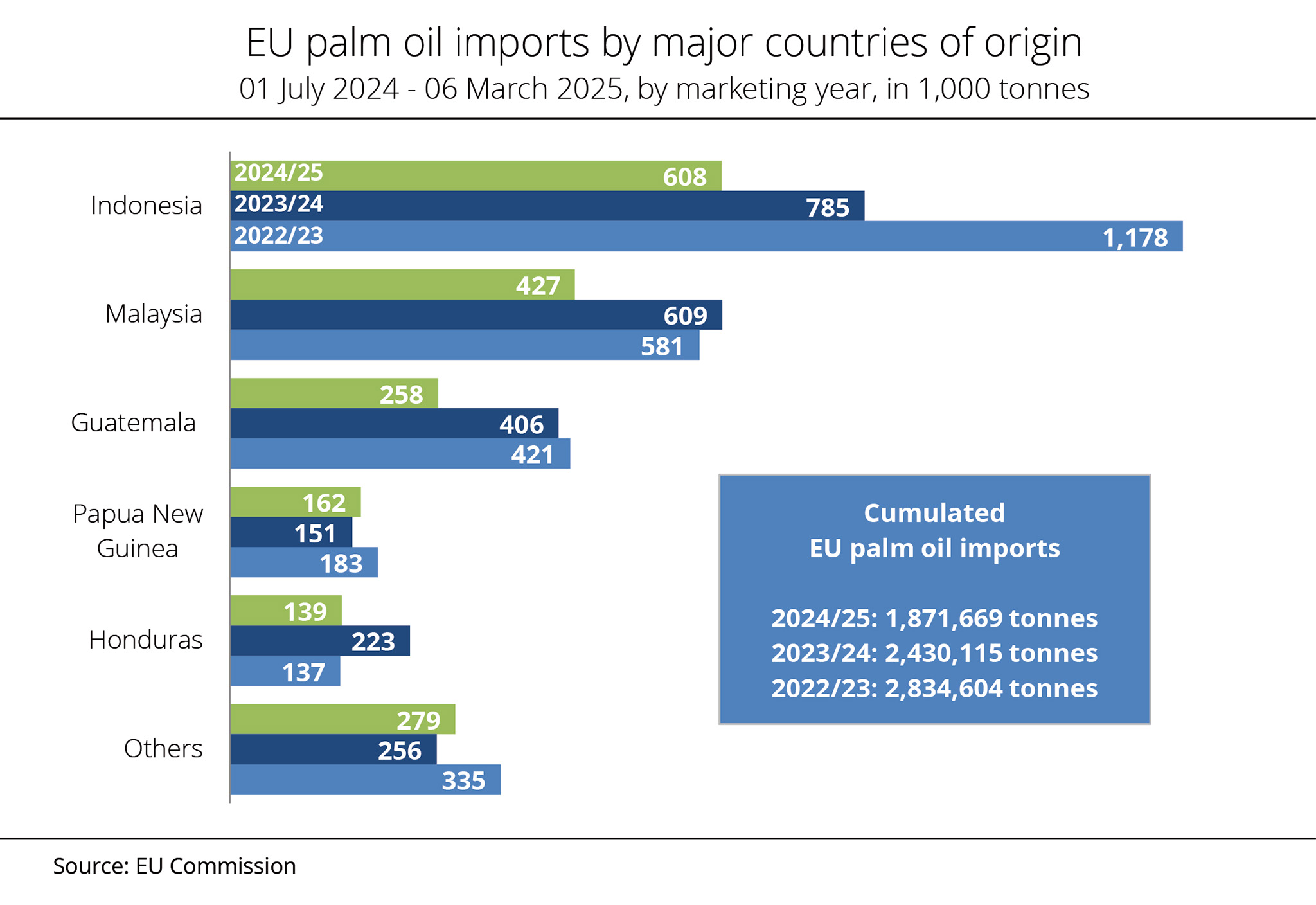

EU-27 imported significantly less palm oil

The EU imported significantly less palm oil between July 2024 and early March 2025 than in the same period a year earlier, reflecting an overall decline in intra-Community consumption.

According to latest data from the EU Commission, the Union received just under 1.9 million tonnes of palm oil from abroad between 1 July 2024 and 6 March 2025, which represents a sharp decline compared to the 2.4 million tonnes received during the same period the previous year. Between July 2022 and March 2023, EU-27 palm oil imports had still totalled around 2.8 million tonnes.

Indonesia remains the leading supplier, with 608,100 tonnes. However, the country's deliveries between July and early March dropped 23 per cent year-on-year. Imports from Malaysia, the second largest supplier, declined around 30 per cent to 426,000 tonnes. According to research by Agrarmarkt Informations-Gesellschaft (mbH), the slowdown in shipments from Guatemala was even sharper, at 37 per cent. Papua New Guinea was the only country of origin to marginally increase its delivery volumes during the stated period.

The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) attributes the decline in palm oil imports primarily to the expiration of the EU Renewable Energy Directive (RED II) provision allowing biofuels from palm oil to be credited, which is set to end by 2030. Furthermore, the association has underlined that biodiesel supply in Germany - and consequently the EU - is rising due to the double counting of biofuels from certain waste oils towards greenhouse gas reduction obligations. Virtual and creditable previous-year GHG reduction quotas are rushing physical volumes from Germany into the EU market. According to UFOP, this trend is also reflected in the surplus of biodiesel exports from Germany, which rose from 1.27 million tonnes in 2023 to 1.62 million tonnes.

Chart of the week (11 2025)

Vegetable oil prices exceed previous year's levels

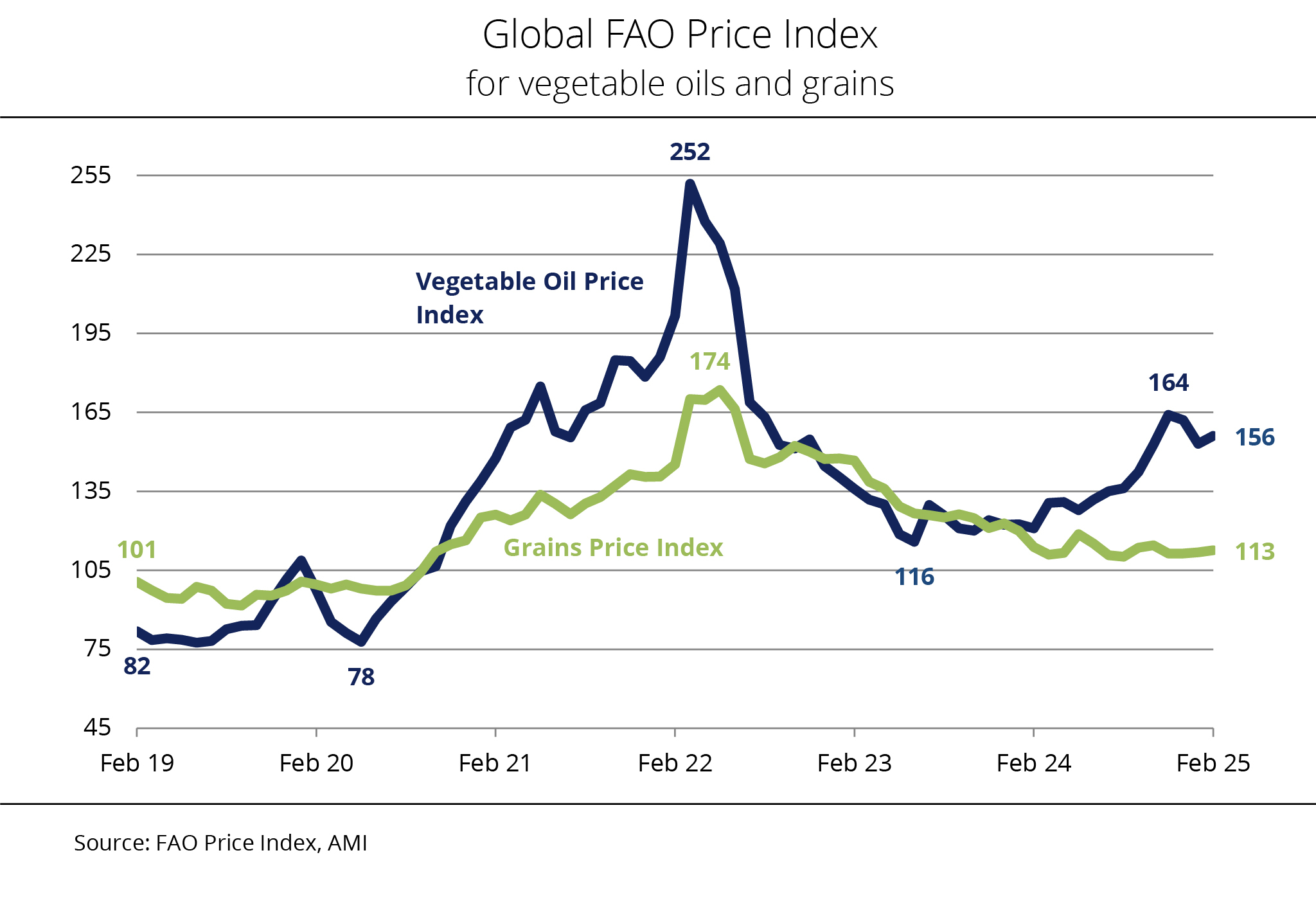

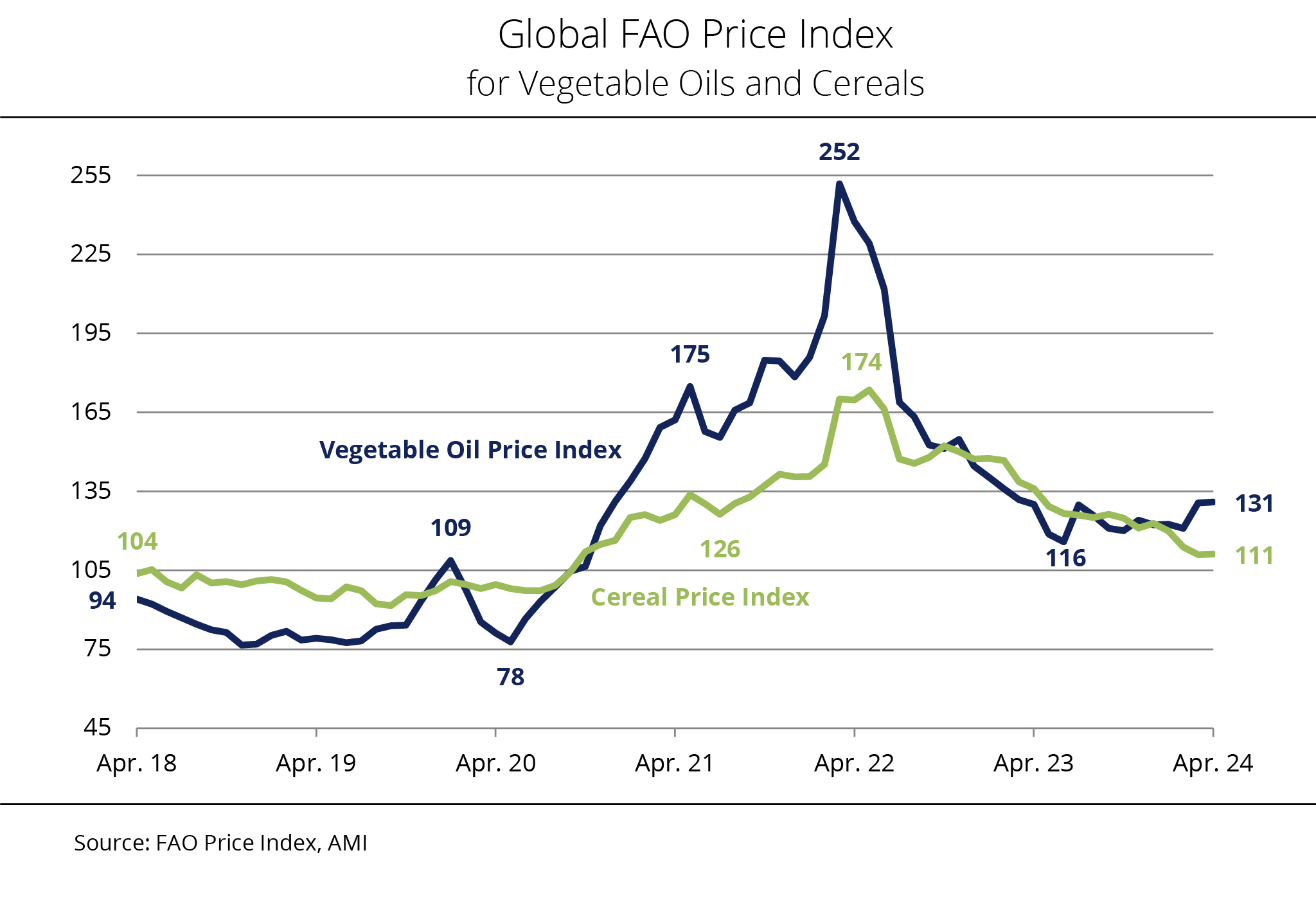

The FAO vegetable oil price index rose in February. The surge in palm oil prices was the main factor driving the index, although all vegetable oils reflected in the index experienced an increase.

The FAO price index for vegetable oils reached approximately 156.0 points in February 2025, which represents a 2 per cent increase month-on-month. Compared to the same month last year, the increase amounts to as much as 29.1 per cent. The key factor was a rise in international palm oil prices, which followed a brief slump in January 2025. Prices rebounded due to the seasonally lower production in key Southeast Asian palm oil-producing countries. Bids also benefited from prospects of increased demand from Indonesia's biofuels industry based on higher blending quota requirements.

This trend also lent supported international soybean oil prices, which FAO experts primarily attribute to strong demand from the food industry. As a result, export prices for sunflower oil and rapeseed oil surged as well, mainly due to concerns over limited supply in the coming months.

The FAO Grain Price Index for experienced a slight 0.7 per cent rise in February, reaching an average of 112.6 points. Wheat prices especially benefited from tighter supply in Russia and concerns over harvesting conditions in Eastern Europe and the US. Maize prices continued to climb, supported by supply shortages in Brazil and strong US export demand.

The FAO vegetable oil price index tracks monthly changes in international export prices for vegetable oils and grains, calculated as a trade-weighted average.

Chart of the week (10 2025)

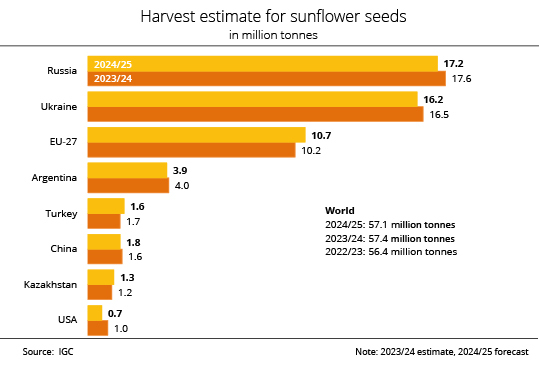

Smallest sunflower seed harvest in four years

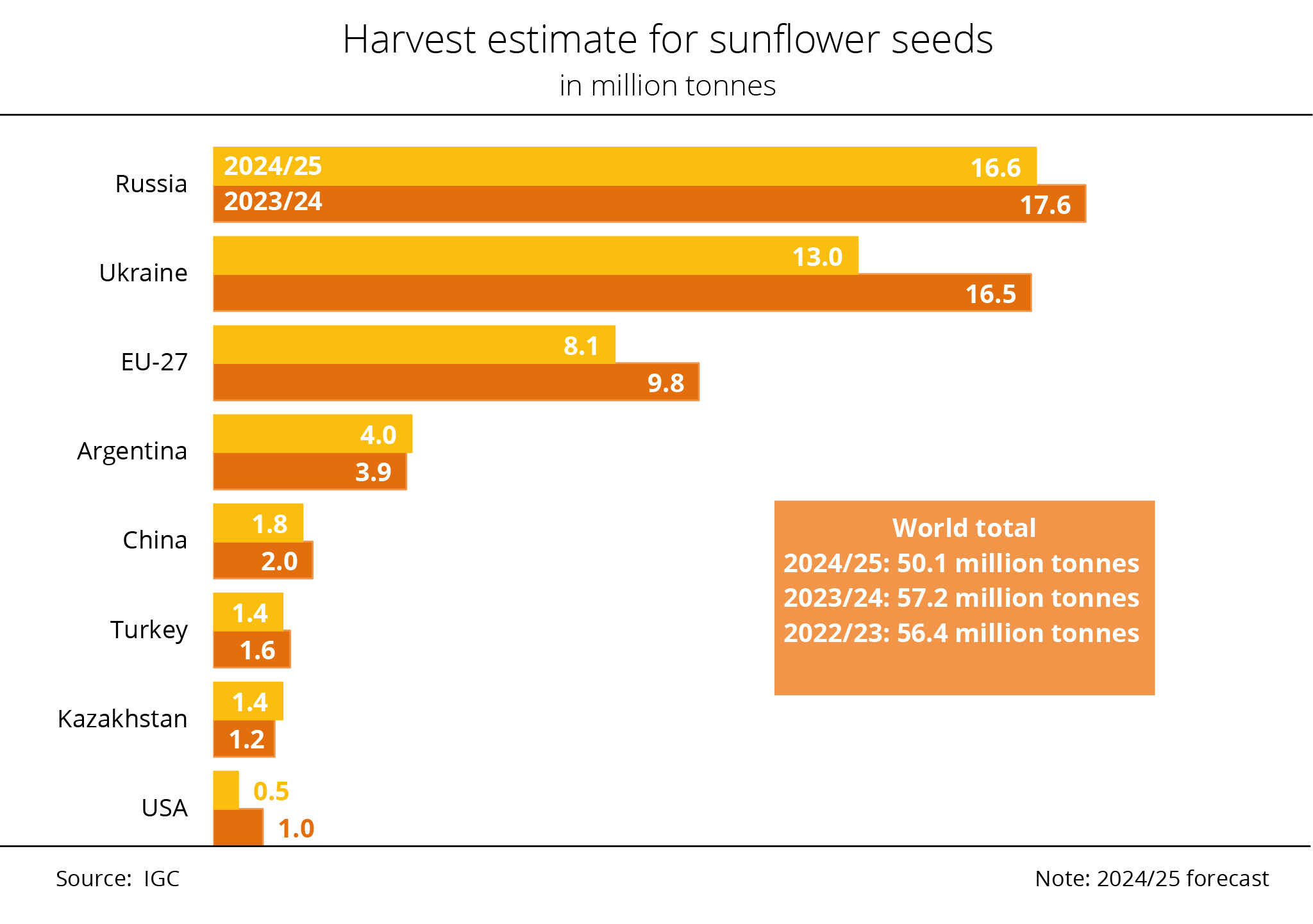

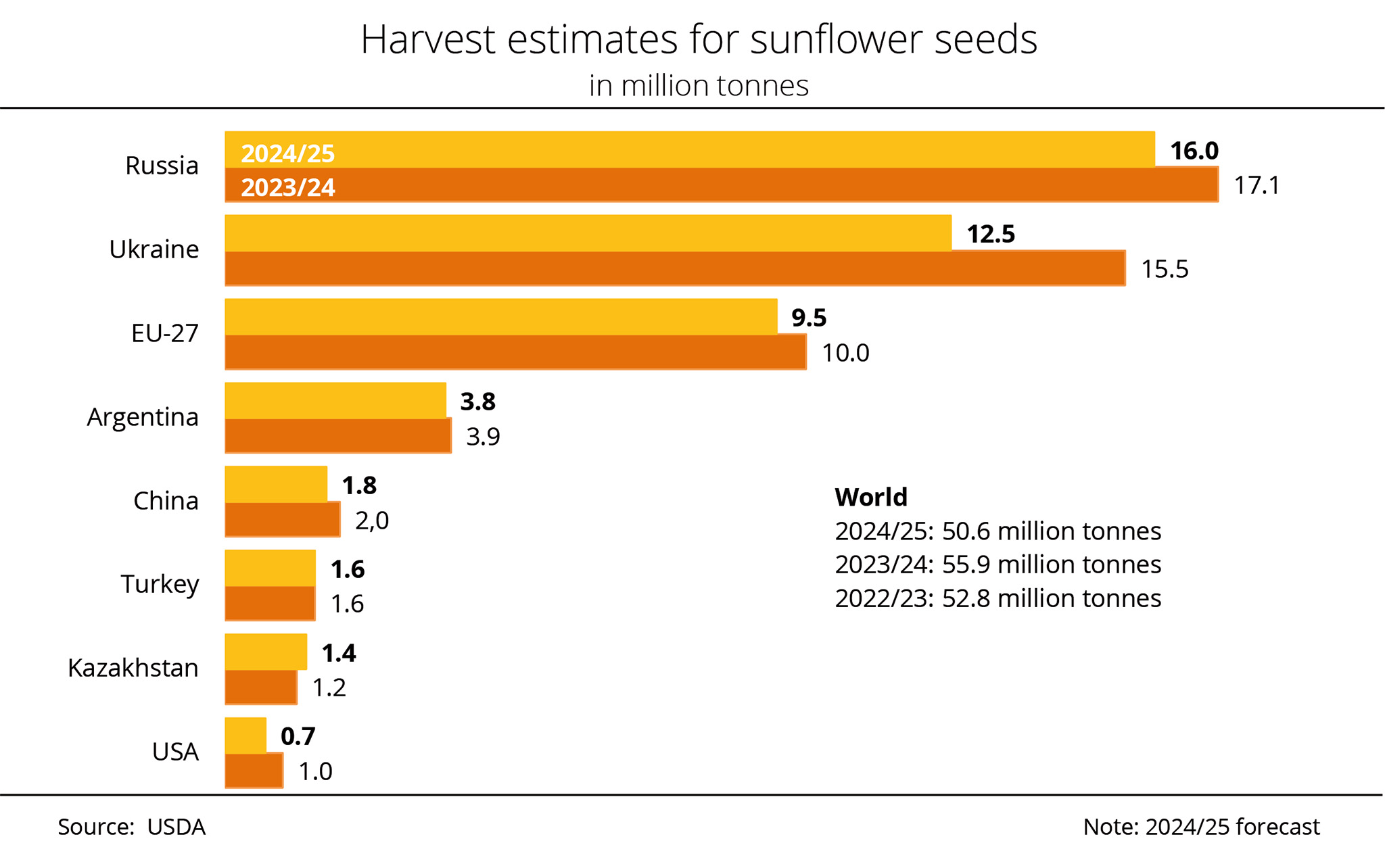

According to recent data from the International Grains Council (IGC), global sunflower seed production will probably reach 50.1 million tonnes in the current season. This figure is not only 100,000 tonnes lower than previously expected, representing a 12.4 per cent decline compared to the 2023/24 crop year, but also marks the smallest harvest in four years.

According to the IGC data, Russia, Ukraine and the EU - the three largest producers of sunflower seed - experienced especially sharp harvest declines compared to the previous year. In Argentina, harvest operations are currently in full swing. Extreme heat and dry conditions recently reduced yields in the country's most important sunflower seed producing regions. In light of this, the IGC lowered its forecast 100,000 tonnes from the previous month. However, research by Agrarmarkt Informations-Gesellschaft (mbH) suggests that approximately 90 per cent of the crops were still in good or excellent condition as of mid-February. Consequently, the harvest, currently projected at 4.0 million tonnes, is expected to increase around 2.6 per cent on 2024.

The US harvest is also seen to be smaller than previously forecast. At around 500,000 tonnes, it likely amounts to only half the previous year’s total of 1.0 million tonnes. By contrast, the estimate for Ukraine's harvest was slightly revised upward. The currently expected 13.0 million tonnes nevertheless represent a 21.2 per cent decline from the previous year’s volume.

Chart of the week (09 2025)

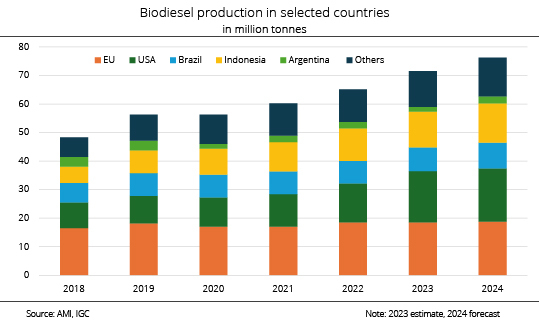

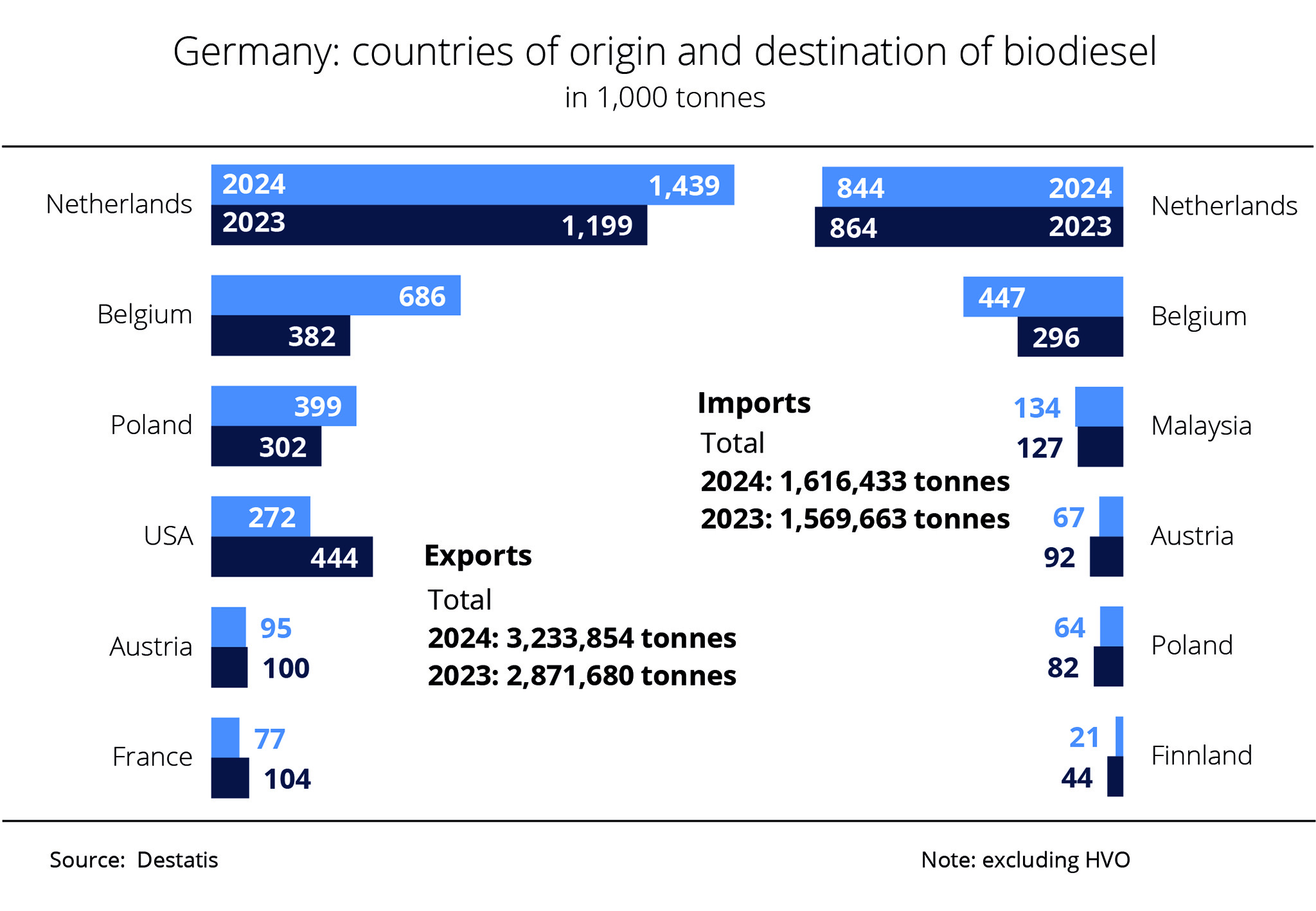

Biodiesel exports reached record high

UFOP: competition for GHG efficiency is driving RME exports

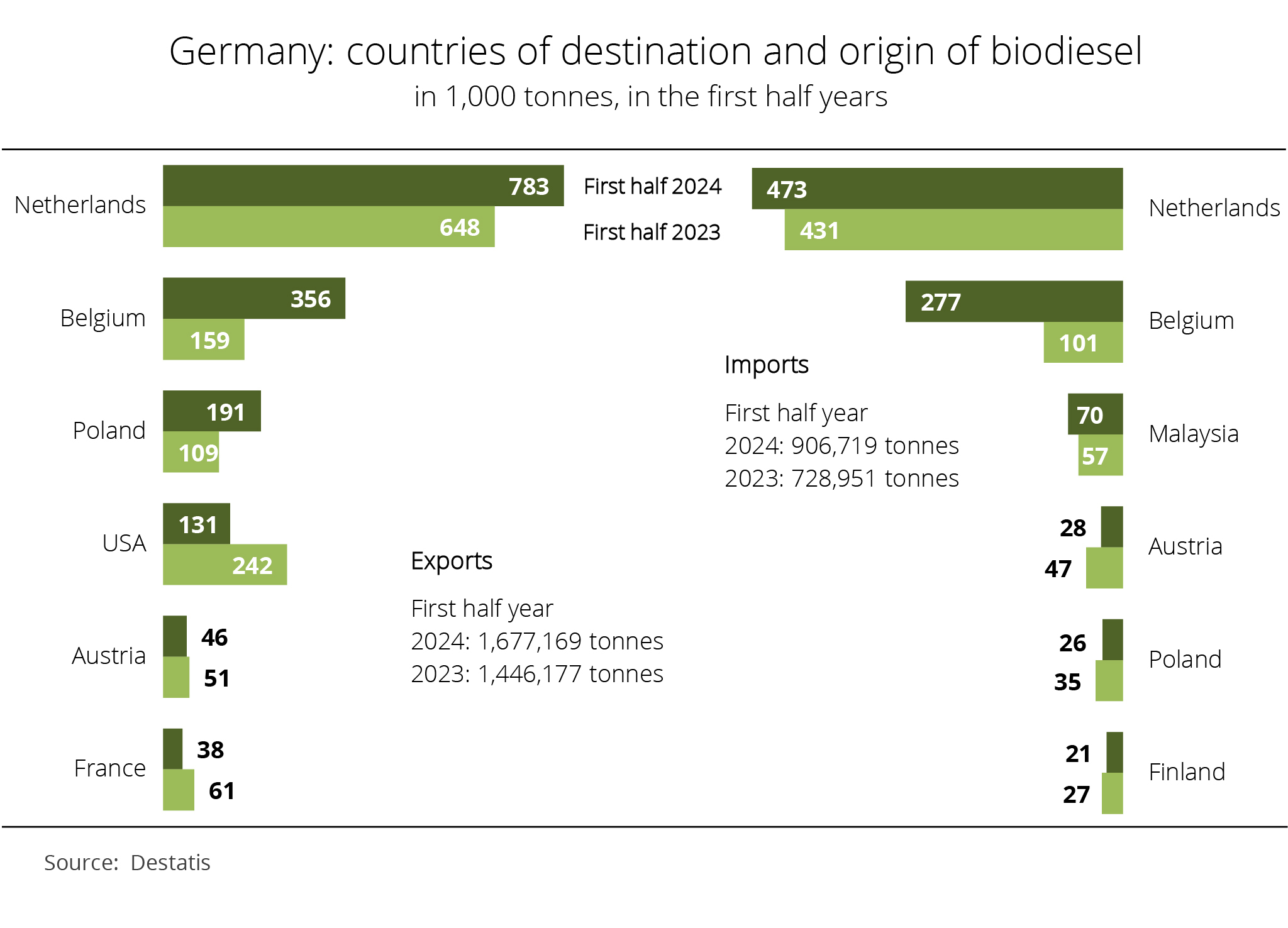

Biodiesel exports from Germany rose for the third consecutive year in 2024, exceeding imports by approximately 1.61 million tonnes. According to information published by the German Federal Statistical Office, they hit a new record of around 3.2 million tonnes. The Netherlands, where Rotterdam serves as the most important hub for world trade in biofuels, remained by far Germany's key trading partner for biodiesel, with shipments increasing 20 per cent year-on-year to just over 1.4 million tonnes.

Exports to Belgium increased 80 per cent to 638,300 tonnes, making Belgium the second largest recipient of German biodiesel. By contrast, exports to the US declined 40 per cent to 271,900 tonnes. According to research by Agrarmarkt Informations-Gesellschaft (mbH), Germany imported 1.6 million tonnes of biodiesel, a decrease of around 3 per cent compared to 2023. The largest volumes came from the Netherlands, Belgium, Malaysia and Austria. Notably, imports from Belgium rose 51 per cent (approximately 151,000 tonnes) to 447,400 tonnes. Imports from Malaysia increased just under 6 per cent. Most of the allegedly fraudulent imports from China obviously also came via Rotterdam in 2024, as data from the German Federal Statistical Office indicate that China itself delivered only 4,000 tonnes directly to Germany.

According to the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP), the German GHG quota policy, the associated competition for GHG efficiency and, in particular, the double counting of biodiesel based on certain waste oils are the main factors driving this trend, which is characterised by a displacement or shift of commodity flows. With regard to fuels in consumers' vehicle tanks the short formula is RME in – UCOME out. The physical threshold for replaceability is set by the diesel (B7) standard, which specifies that HVO must be added when the maximum of 7 per cent by volume is reached. The UFOP has explained that given the rising greenhouse gas reduction obligations and continuing decline in diesel consumption, HVO is currently the only alternative in the diesel market.

In light of the absence of a strategy to increase biodiesel consumption in Germany – despite the country's failure to meet climate protection targets in the transport sector –, the UFOP has pointed out that Germany once again exported a considerable GHG reduction potential in the transport sector last year, namely 1.61 million tonnes of RME. Carriers increasingly owe the duty to their customers to provide proof of their contributions to mitigating climate change. The association has stressed that the switch to pure biodiesel can be implemented immediately and is also the most cost-effective option.

Chart of the week (08 2025)

Brazilian soybean harvest set to hit another record high - UFOP: Will the EUDR be able to stop the expansion of soybean area?

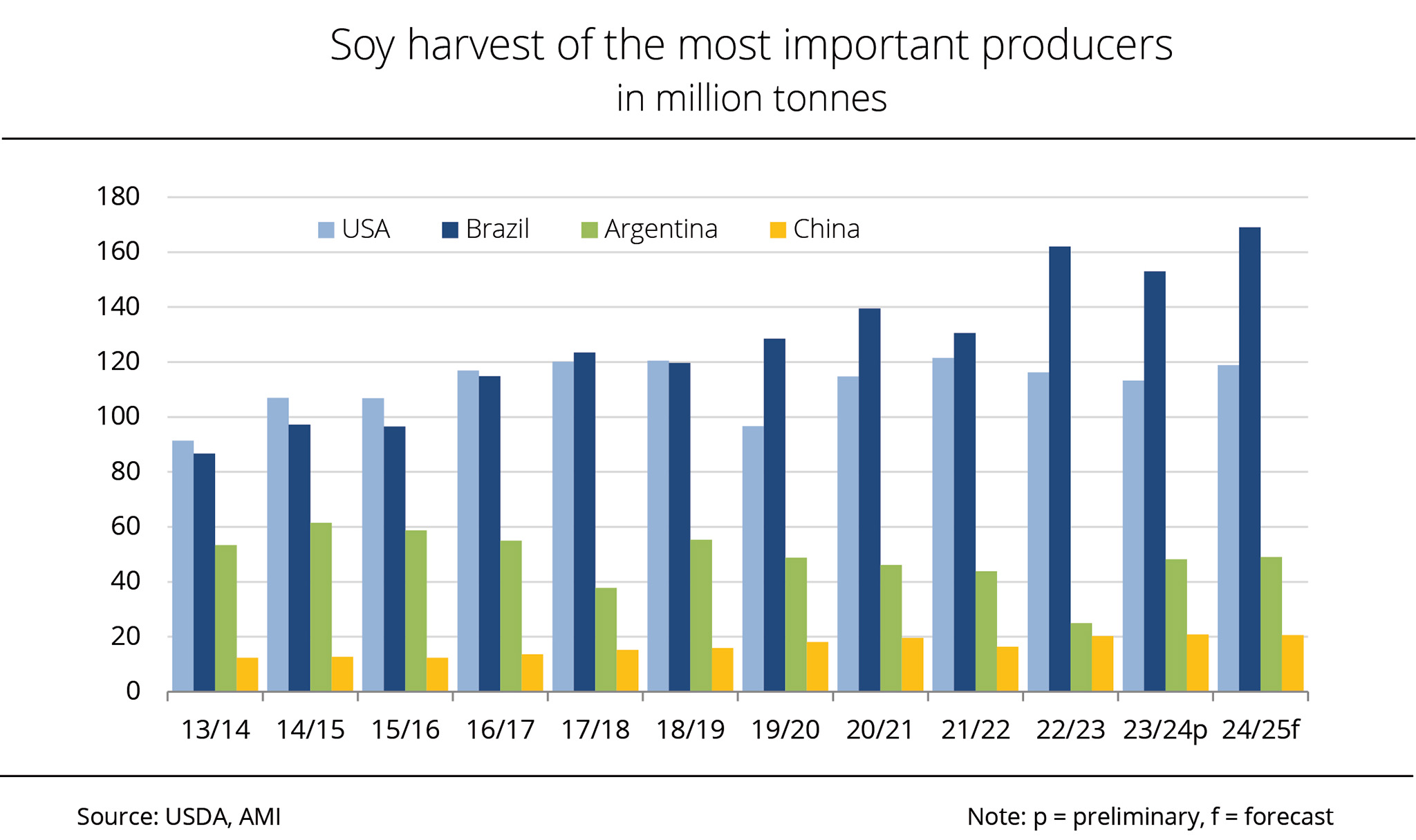

Brazil and Argentina continue to consolidate their shares in the global soybean market this marketing year, with Brazil expecting another bumper crop.

Brazil, the US and Argentina are the world's main producers of soybeans, collectively accounting for 80 per cent of global production. China follows a long way behind with a market share of 5 per cent. According to estimates from the US Department of Agriculture (USDA), Brazil is set to harvest a record volume of around 169 million tonnes of soybeans in the current crop year. This figure compares to 153 million tonnes a year earlier. Based on a 1.3 million hectare expansion in soybean area to 47.4 million hectares, Brazil consolidates its position as the world's number one soybean producer ahead of the US. The Brazilian soybean harvest is currently in full swing. As of 7 February 2025, the harvest was approximately 15.1 per cent complete, the long-standing average for the same date being 18.4 per cent. Yields have previously been reported as more than satisfactory. In the US, the soybean harvest was already complete by the end of the year 2024, totalling around 118.8 million tonnes. This translates to an almost 5.6 million tonne increase over the previous year and is presumably the largest crop in three years.

Argentina, which ranks third among the world's most important producers, is also projected to see a slightly larger harvest compared to the previous year. According to research by Agrarmarkt Informations-Gesellschaft (mbH) the country is expected to harvest 49 million tonnes, around 790,000 tonnes more than the previous year. In contrast, latest USDA estimates indicate that China's harvest will decline around 190,000 tonnes from the past year, falling to 20.7 million tonnes.

In view of the unabated rise in Brazil's soybean area, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has questioned the potential regulatory effect of the EU Deforestation Regulation (EUDR). The UFOP fears that the soybean marketing chain from Brazil will be split into two streams – one flowing to the European Union, with proof of land use as of January 2020, and another serving Brazil's primary soybean market China. According to information published by Statista, China imported approximately 106 million tonnes of soybeans in 2023. With an average yield of approximately 3.3 tonnes per hectare, this translates to a land area requirement of approximately 32 million hectares. For comparison: Ukraine's total cropland extends over 33 million hectares. In view of the extension of the implementation period of the EUDR until the end of 2025, the UFOP has said that it remains to be seen whether the EUDR and companies' voluntary commitment to protect primeval forests will create a positive impact on the environment, adding that the effectiveness of such measures will be limited unless rules are agreed to protect primeval forests and biodiversity across all global commodity flows.

Chart of the week (07 2025)

Ukraine covers bulk of EU sunflower seed oil imports

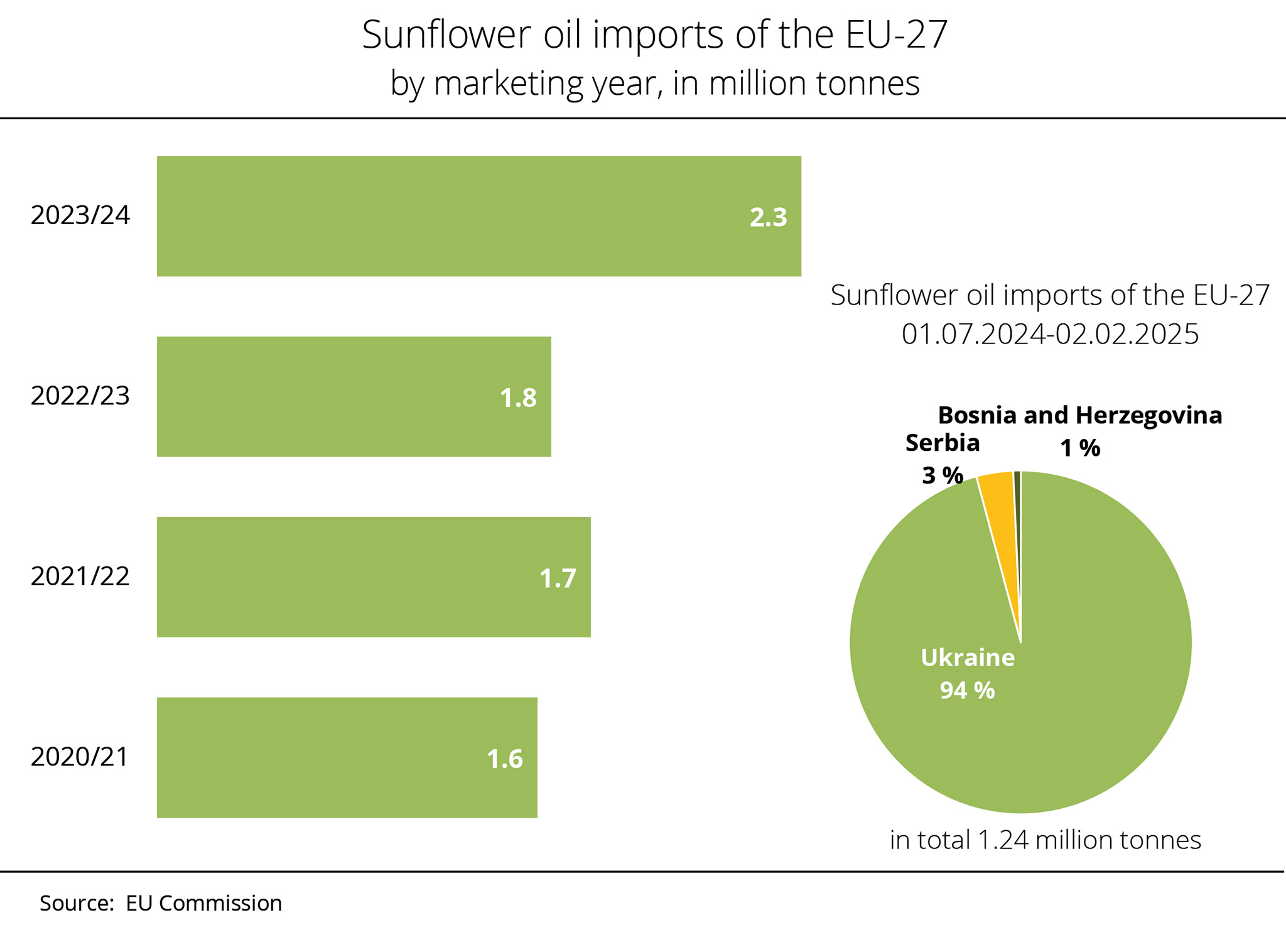

Figures published by the EU Commission show that Ukraine remains by far the largest supplier of sunflower seed oil to the EU-27, despite a Ukrainian decline in feedstock supply compared to the previous year.

From 1 July 2024 to 2 February 2025, the EU- 27 imported around 1.24 million tonnes of sunflower seed oil, which was significantly less than the 1.51 million tonnes imported during the same period the previous year, but more than the 1.13 million tonnes recorded in the 2022/23 marketing season. However, imports slowed down substantially in recent weeks, with weekly import volumes falling from nearly 59.000 tonnes in December to just under 25,000 tonnes at the beginning of February.

Ukraine is the by far leading country of origin, delivering 1.17 million tonnes of sunflower seed oil to the EU so far this season. According to research by Agrarmarkt Informations-Gesellschaft (mbH), this translates to a market share of 94 per cent. However, the volume is nevertheless lower than the 1.40 million tonnes supplied during the same period the previous year. The decline is due to the significant drop in feedstock supply in the running season, which has reduced processing and limited Ukraine's sunflower seed oil export potential. Serbia and Bosnia are the second and third most important suppliers, holding market shares of 3 per cent and just under 1 per cent respectively. However, their exports also remained short of the previous year's levels.

Chart of the week (06 2025)

Hungary becomes the EU's top sunflower seed producer for the first time

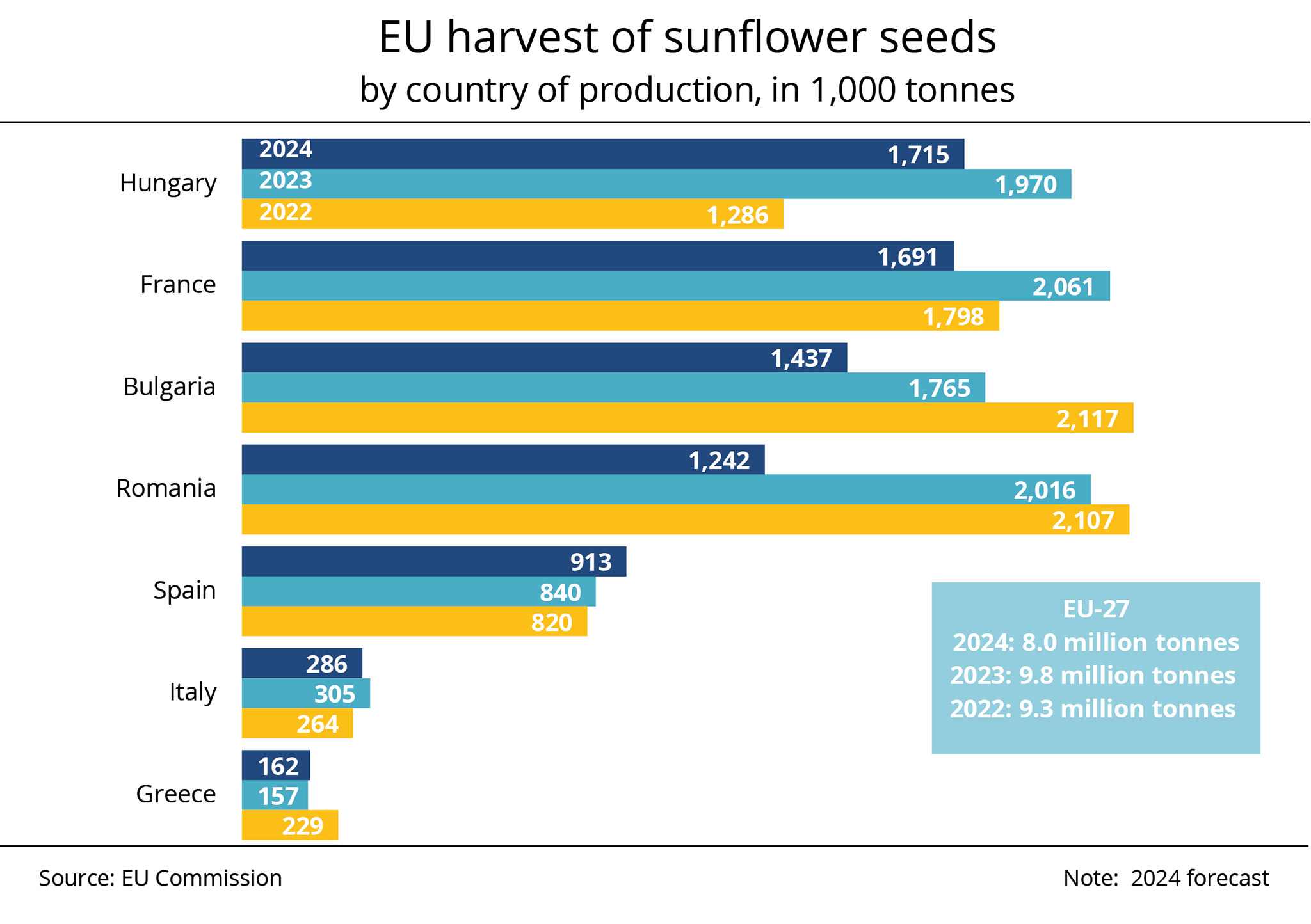

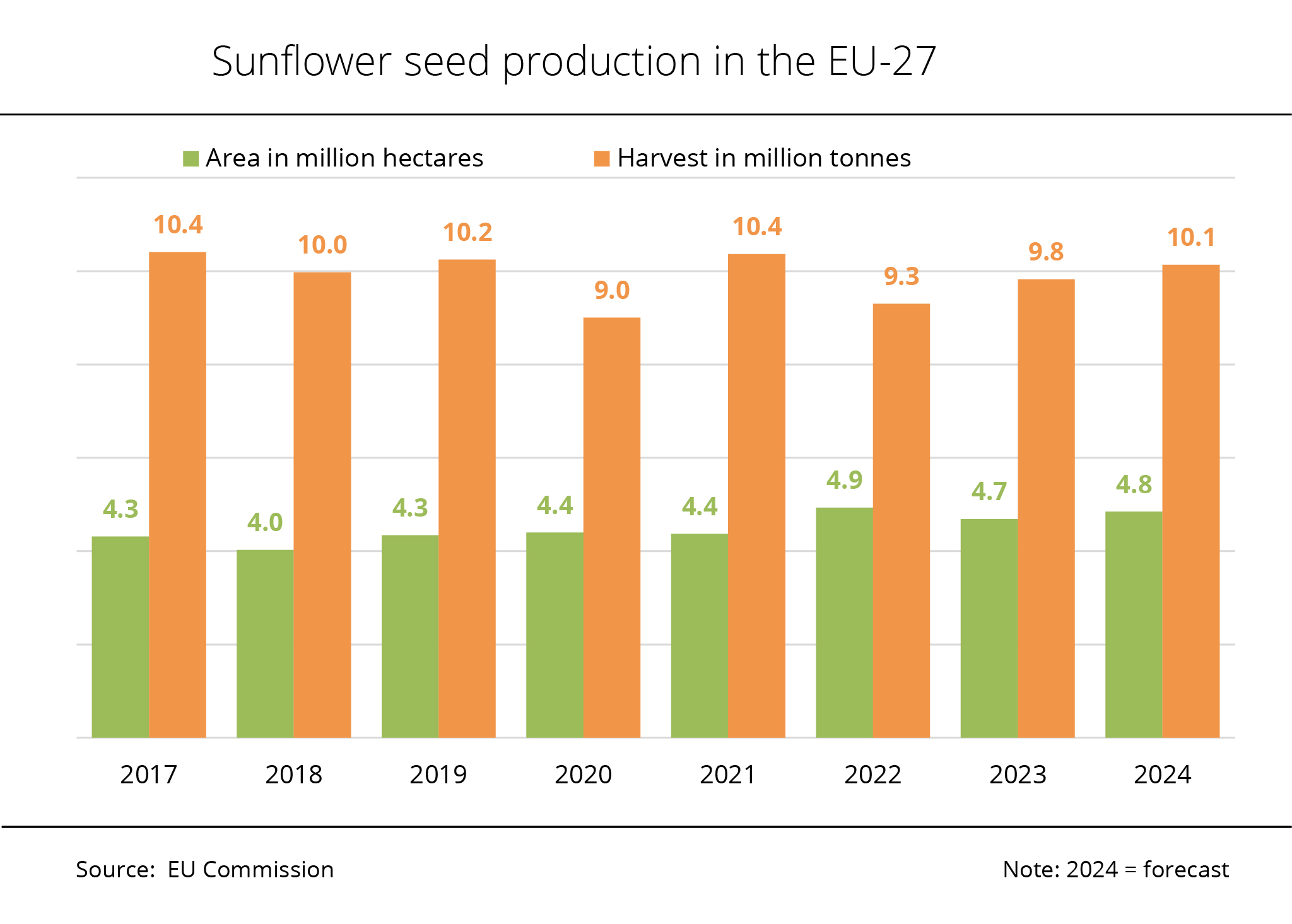

The EU Commission slightly lowered its forecast of sunflower seed output in its February estimate for the 2024 oilseed harvest.

According to recent information by the EU Commission, the 2024 EU sunflower seed harvest is seen to total around 8.0 million tonnes, 7,000 tonnes less than expected at the end of December. The revision increases the year-on-year decline to 18 per cent, as unfavourable weather conditions throughout the year significantly curtailed yield potential. The harvest also falls 18 per cent short of the long-term average, representing the EU's smallest sunflower seed harvest since 2015.

The downward revision is mainly due to the smaller crop in Germany. The Commission now forecasts German production at 127,000 tonnes, 7,000 tonnes below the December estimate. This represents a 25 per cent drop from 2023, but remains just about 20 per cent above the five-year average. Many farmers had expanded sunflower cultivation significantly in 2022 following the start of the war in Ukraine and the sharp rise in producer prices, but scaled back production the following year.

The harvest in Romania also declined compared to 2023, falling 38 per cent to 1.2 million tonnes. Despite a record area planted with sunflower seed, this would represent the country's smallest harvest in fifteen years. As a result, Romania lost its top position as the EU's largest producer, dropping to the fourth place. In contrast, Hungary climbed to first place for the first time, harvesting 1.7 million tonnes despite a presumed 13 per cent decline from the previous year. In France, crop development and harvest operations were severely impacted by persistent rainfall, according to research by Agrarmarkt Informations-Gesellschaft (mbH). With 1.7. million tonnes currently projected, France ranks second largest producer within the Community despite an 18 per cent decrease compared to the previous year.

Chart of the week (05 2025)

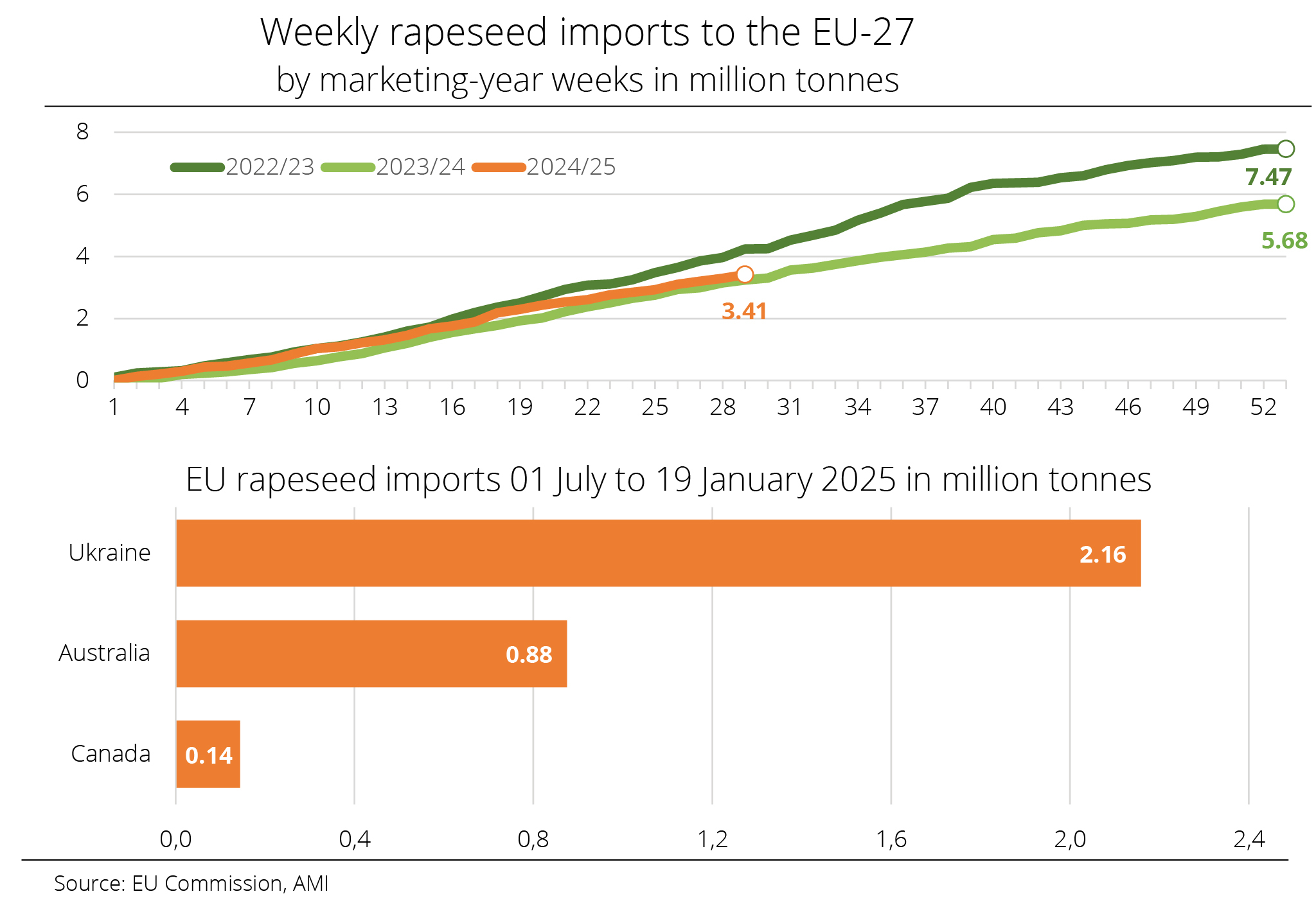

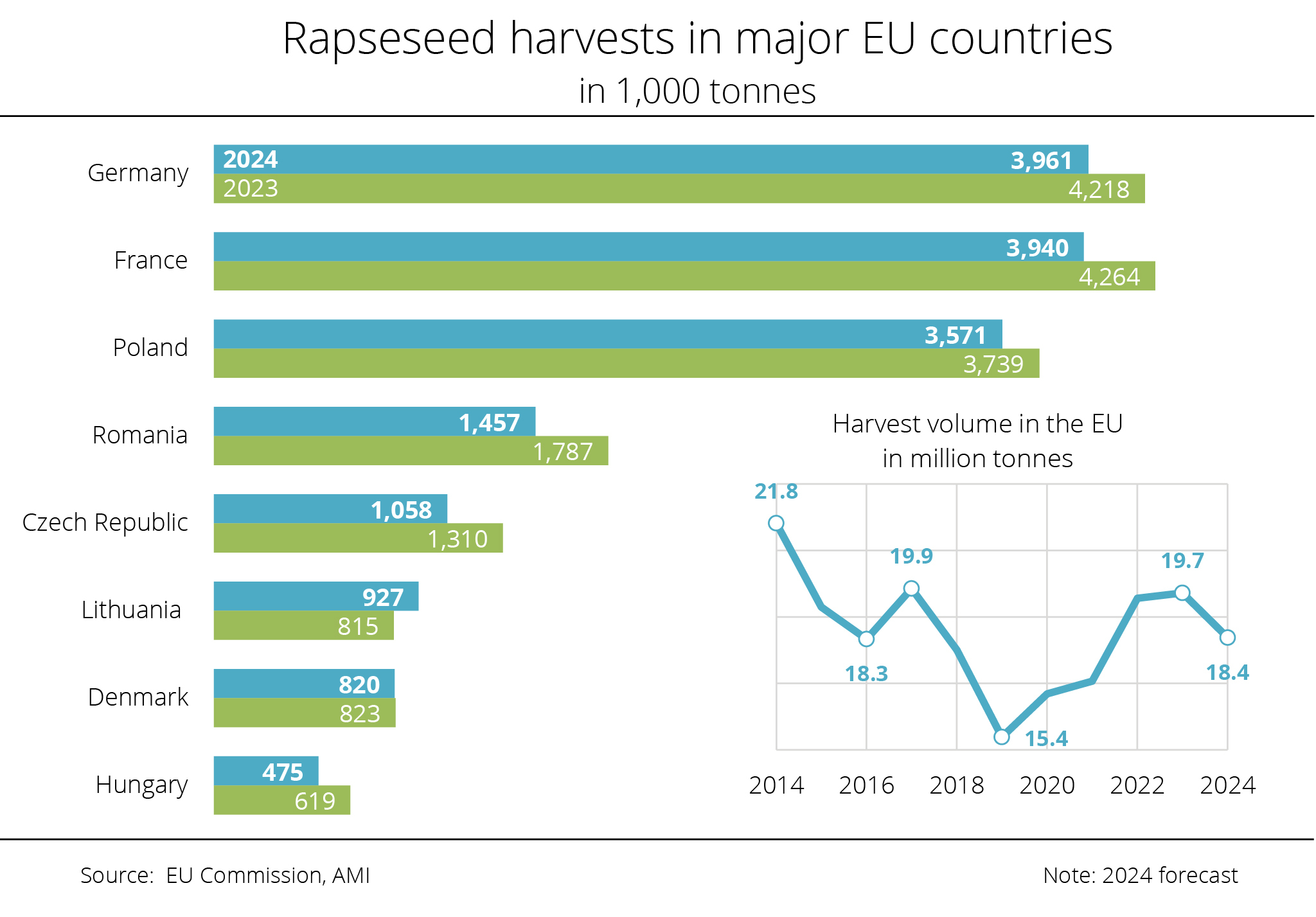

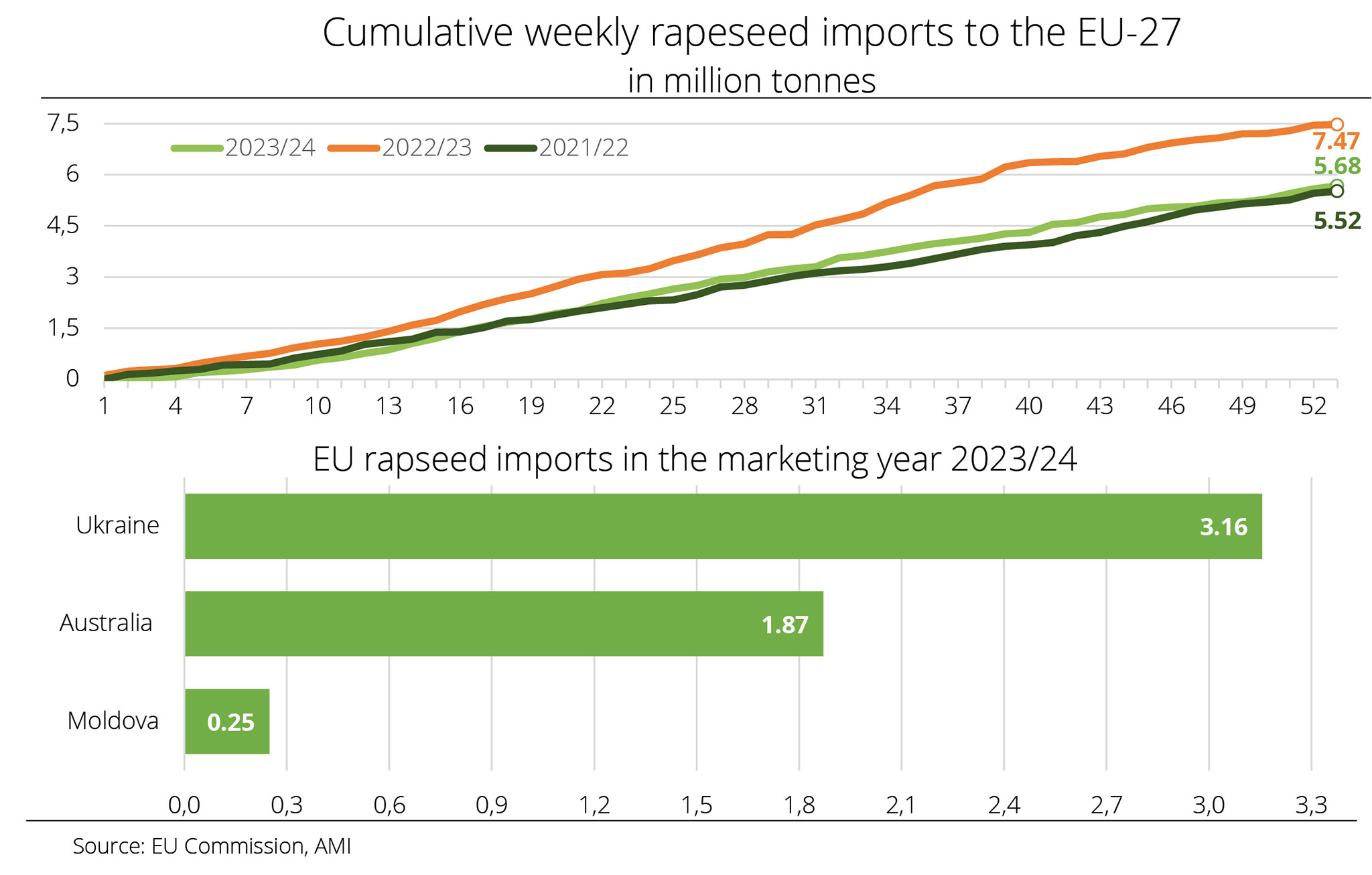

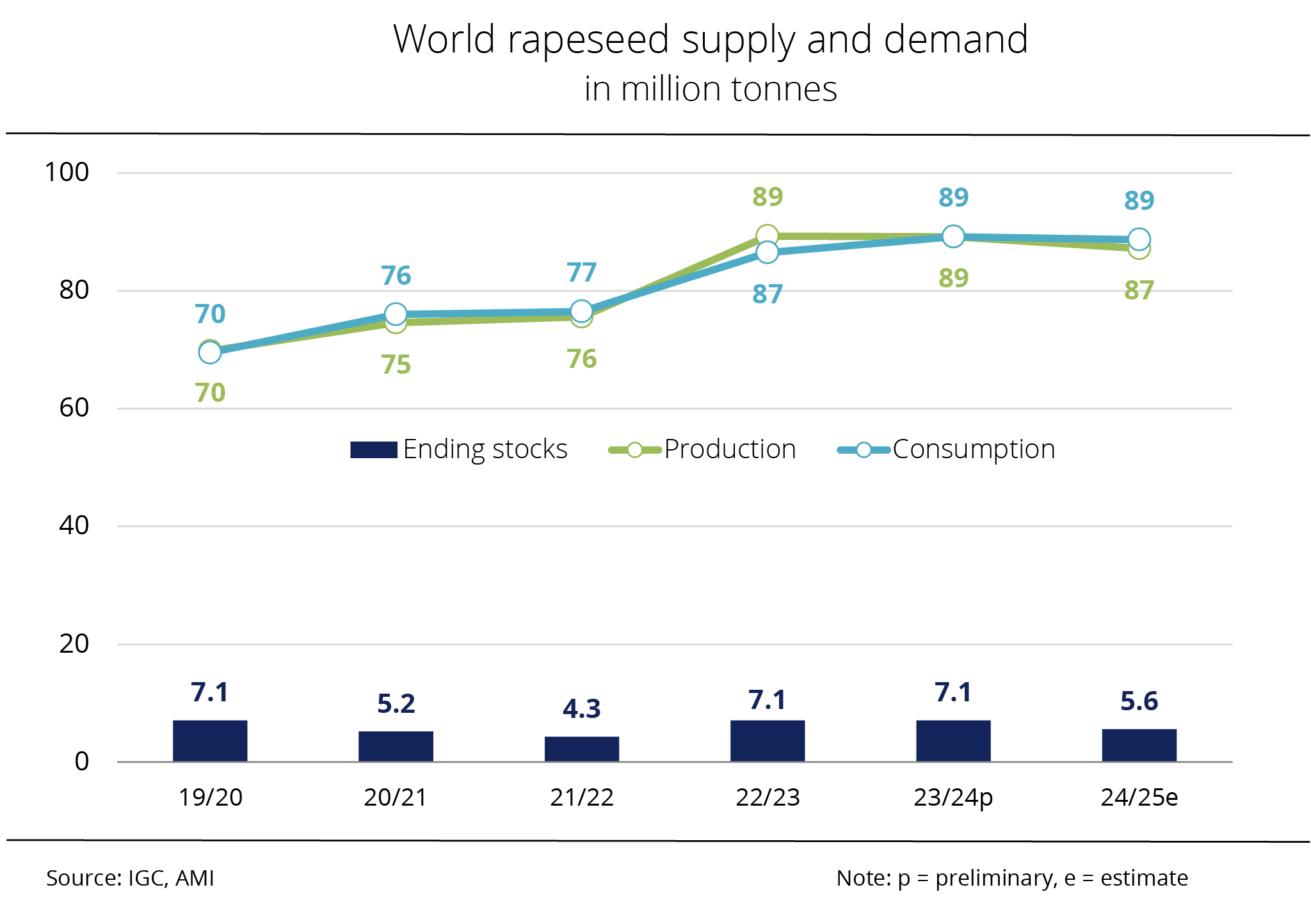

Higher demand for rapeseed imports due to smaller EU harvest

The EU Commission significantly lowered expectations concerning the European 2024 rapeseed harvest at the end of last year, reducing its forecast to approximately 17.2 million tonnes. Given the smaller crop and an expected rapeseed processing volume of about 23 million tonnes, this means that the EU will rely more on imports. Most imports go to German oil mills, which have a processing capacity of approximately 10 million tonnes of rapeseed. Whereas Ukraine was the most important rapeseed source in the first half of the crop year, Canada and Australia moved into focus towards the turn of the year.

Between the beginning of the 2024/25 crop year and 19 January 2025, EU rapeseed imports totalled 3.4 million tonnes, representing an increase of just over 5 per cent over the previous year. Accounting for 63 per cent of EU imports, Ukraine remains the key country of origin, as in previous years, seeing a slight rise in deliveries from 2.1 million tonnes the previous year to 2.2 million tonnes. The second wave of imports from Australia will increasingly move into focus in the second half of the crop year. By mid-January, Australia had already placed 875,000 tonnes of rapeseed on the EU market. According to research by Agrarmarkt Informations-Gesellschaft (mbH), this represents an around 19 per cent rise on the previous year's reference period. Accounting for almost 26 per cent of EU rapeseed imports, Australia remains the second most important rapeseed supplier to the EU, followed by Canada with 144,000 tonnes. Canadian deliveries more than tripled compared to the previous year, if at a low level. Because Canadian farmers grow genetically modified varieties, the use of rapeseed oil derived from Canadian rapeseed is restricted in the EU. Imports are therefore mainly used for biofuel production. In contrast, Serbia and Moldova supplied only a fraction of the previous year’s volume.

Chart of the week (04 2025)

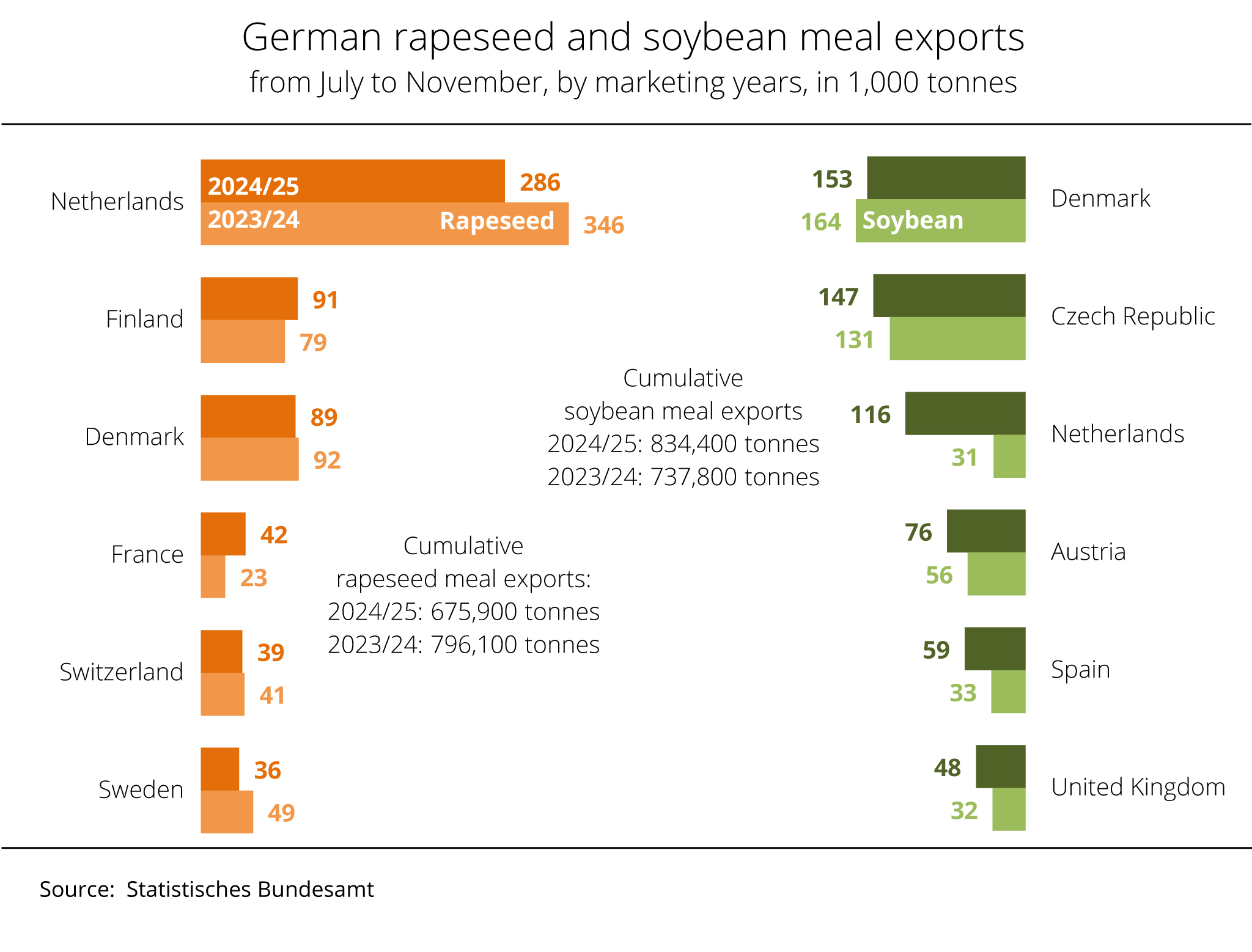

Germany exported more soybean meal and less rapeseed meal

According to information from the German Federal Statistical Office, German oil mills increased their soybean exports 13 per cent to 834,000 tonnes in the period July to the end of November 2024 compared to the same period in 2023. At the same time, exports of rapeseed meal declined around 15 per cent to 675,900 tonnes.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), most rapeseed and soybean meal produced in Germany was exported to other EU countries. The ports in the Netherlands were the main recipients for global shipments, as they were in previous years. From July to November 2024, Germany sold around 285,800 tonnes of rapeseed meal to this neighbouring country, representing a 17 per cent decline from the same period the previous year. At around 89,200 tonnes, Denmark also received 3 per cent less, dropping down to third place among the most important recipients. Rapeseed meal exports to Sweden and Switzerland also remained below the previous year's levels. German deliveries to Finland rose around 16 per cent to 91,000 tonnes compared to the first five months of the 2023/24 marketing year. Notably, deliveries to France climbed around 81 per cent, reaching 42,000 tonnes.

The soybean meal produced also went mostly to EU countries. Denmark, one of the EU's leading producers of pork, is the largest market. Nevertheless, in the period from July to November 2024, Germany's deliveries of soybean meal dropped approximately 6 per cent to 153,200 tonnes compared to the same year-earlier period. In contrast, deliveries to the Netherlands jumped 31,000 tonnes to 116,000 tonnes.

Chart of the week (03 2025)

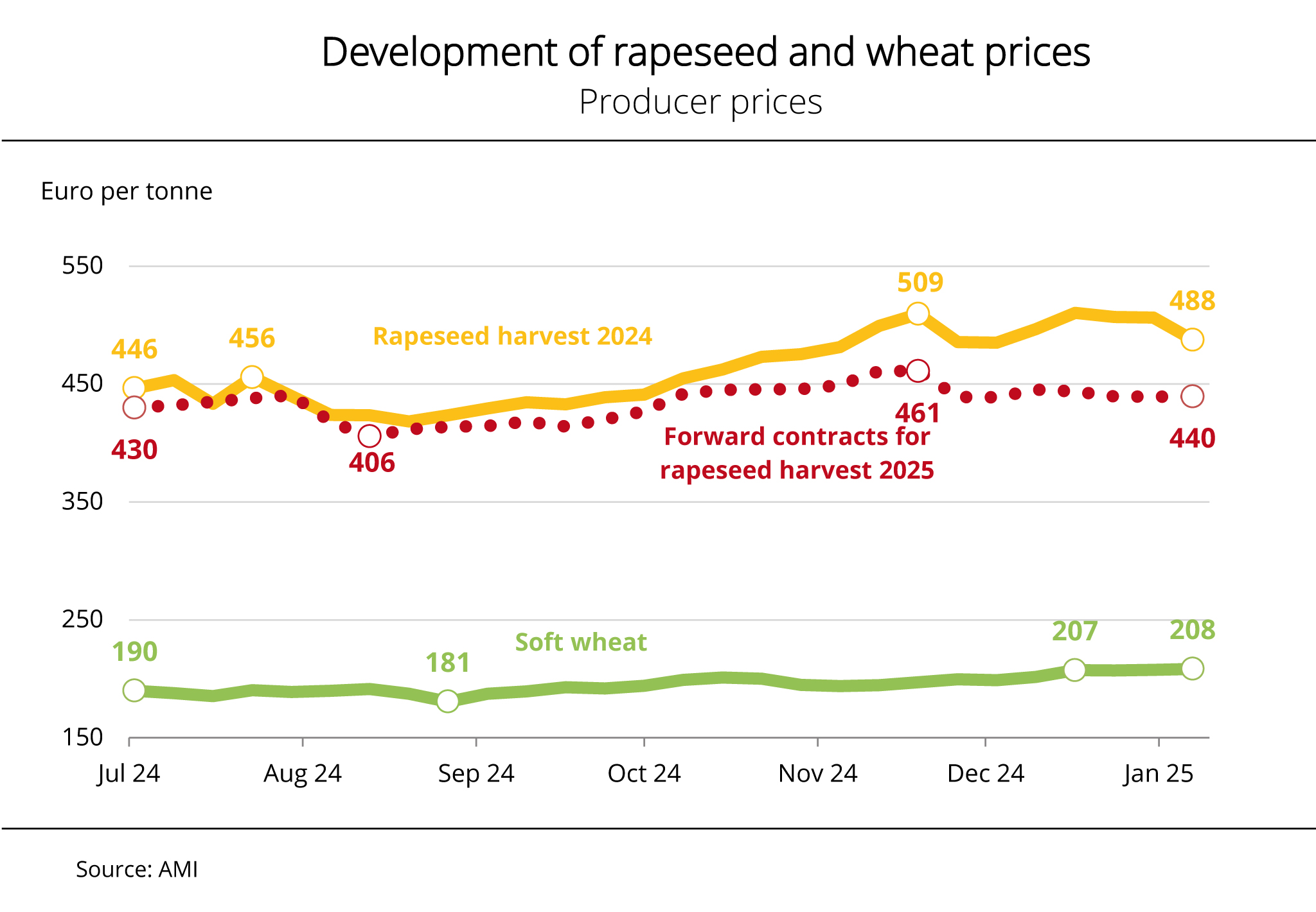

Price gap over wheat makes rapeseed production more attractive

Ex-farm prices of rapeseed climbed over the course of the year. By the end of 2024, they hovered around the mark of 500 EUR per tonne, a level not seen since the start of the war in Ukraine. Soft wheat moved up and down at the producer level throughout the year but did not exceed the previous year's level slightly until December. As a consequence, the price spread between rapeseed and soft wheat has grown continuously. Most recently, rapeseed fetched almost 2.5 times the price of wheat.

Ex-farm prices of rapeseed and soft wheat surged sharply over the past weeks. Futures market prices of rapeseed almost reached levels last recorded nearly three years ago when concerns over global supply were rising at the start of Russia's war of aggression against Ukraine. Despite ongoing volatility, the smaller supply from Europe, Canada and Australia in particular is currently supporting prices. Support has also come from the crude oil and soybean markets. Developments on the cash market were similar, even though producer prices were under pressure at the beginning of the year, falling back below the line of 500 EUR per tonne. Nevertheless, prices at the beginning of 2025 were almost EUR 100 per tonne higher than the previous year.

Producer prices of soft wheat fluctuated strongly throughout 2024, eventually climbing above the level of 200 EUR per tonne in December. This led to a price gap of around 7 EUR per tonne on the previous year. Early-year trading has been quite moderate with a wait-and-see approach prevailing. Processors are well supplied and are waiting out the current weakening trend for the moment. In any case, producers show little willingness to sell at the current price level.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has noted that a price gap in favour of rapeseed increases the crop's attractiveness in crop rotation planning. At the same time, the UFOP has emphasised that producer prices should always be at a level that will allow farms to generate sustainable profits.

Given the current and foreseeable tough economic environment, the UFOP expects the new German government to make the right decisions to address regulative challenges appropriately. The UFOP has stressed the need for a holistic and sustainable arable farming strategy to ensure competitive and future-proof arable farming. The economy should be taken into appropriate account as a guiding principle, alongside societal acceptance. The economy should be taken into appropriate account as a guiding principle, alongside societal acceptance. In the future, the definition and remuneration of ecosystem services resulting from the diversification of crop rotations with oil and protein crops will become increasingly important. The association has emphasised that nevertheless, the harvest result in combination with an attractive producer price should be main factors determining a farm's financial balance

Chart of the week (01 2025)

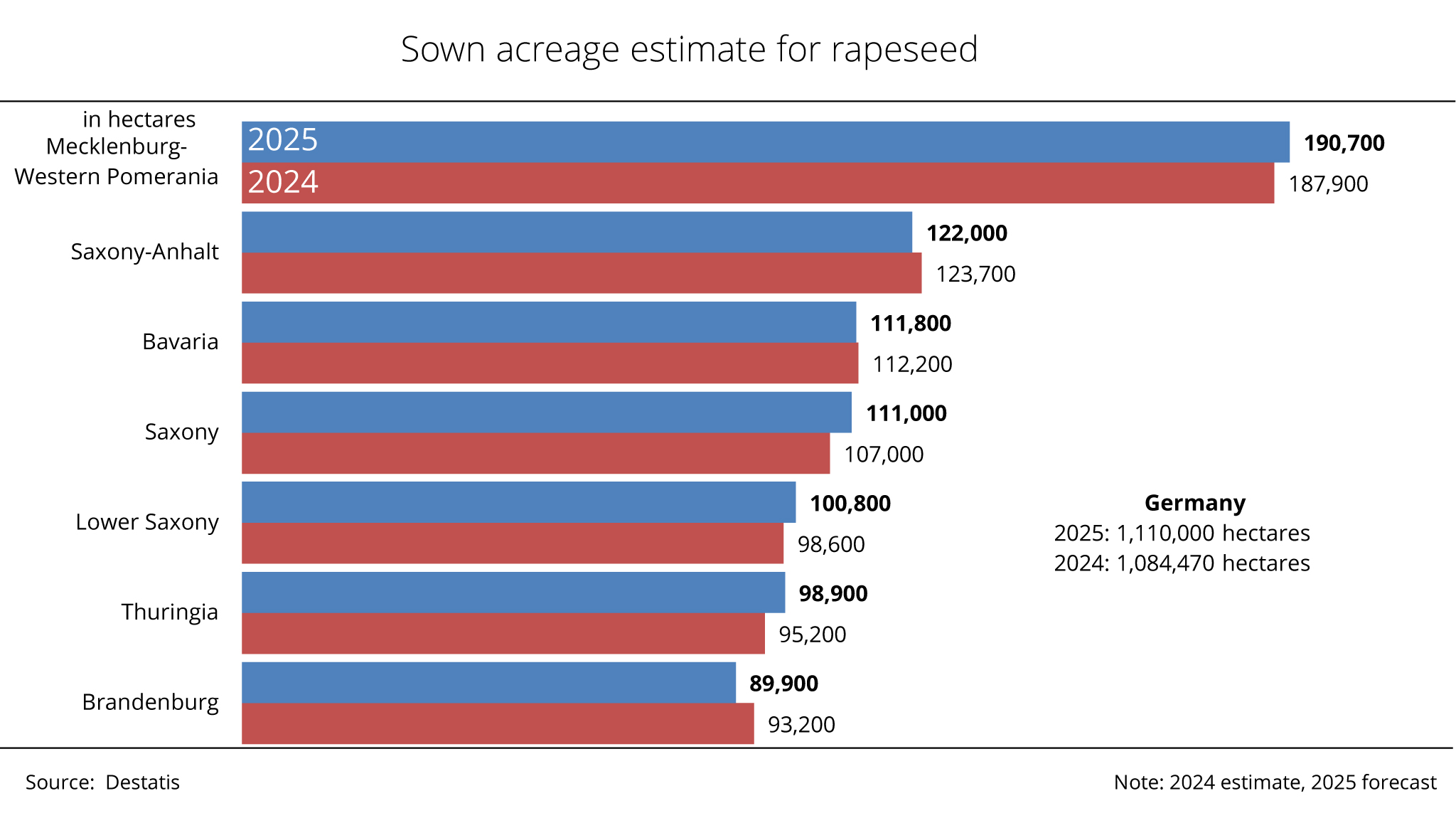

German Federal Statistical Office expects increase in rapeseed hectarage in Germany

The rapeseed area in Germany has been expanded in nearly all German states, reaching a total of 1.1 million hectares. Declines were only recorded in Brandenburg and North Rhine-Westphalia. This is the result of the latest forecast published by the German Federal Statistical Office (Destatis).

In its mid-November 2024 estimate, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) anticipated a decline of several 10,000 hectares in area sown with winter rapeseed, projecting a total of 1.05 to 1.09 million hectares. The association attributed the reduction in planted area to insufficient price incentives for crop rotation planning, adding that traders and processors should set the required price signals well in advance of sowing. The UFOP also pointed out that, due to increasing demand for biofuels production - particularly as palm oil becomes less available as a feedstock - rapeseed is currently in high demand, and this trend is expected to continue. By 2023, the demand gap is set to widen and rapeseed, particularly rapeseed oil, will be needed as an "iLUC free" feedstock to close the gap. By way of a qualification, the UFOP has emphasised that feedstock potential is dependent on crop rotation restrictions. It is widely acknowledged that rapeseed can be grown every four years to ensure resilience and sustainability in arable farming.

The UFOP views both the result of its own estimate and the forecast by the German Federal Statistical Office as initial guidance for the 2025 harvest area and as a first yield estimate. The rapeseed acreage estimated by the German Federal Statistical Office translates to a 2.3 per cent increase compared to the previous year, which would represent the second largest winter rapeseed acreage since 2018. Based on the area sown with rapeseed and average yields over the past five years, Agrarmarkt Informations-Gesellschaft mbH (AMI) has estimated the rapeseed harvest at just over 4 million tonnes. The UFOP has emphasised that the area sown is, by nature, not the same as the area harvested. The importance of rapeseed cultivation in eastern Germany is noteworthy. Just over 55 per cent of the German rapeseed area is located in Brandenburg, Mecklenburg-Western Pomerania, Saxony-Anhalt, Saxony and Thuringia.

Chart of the week (51 2024)

Palm oil imports to the European Union continue to dwindle

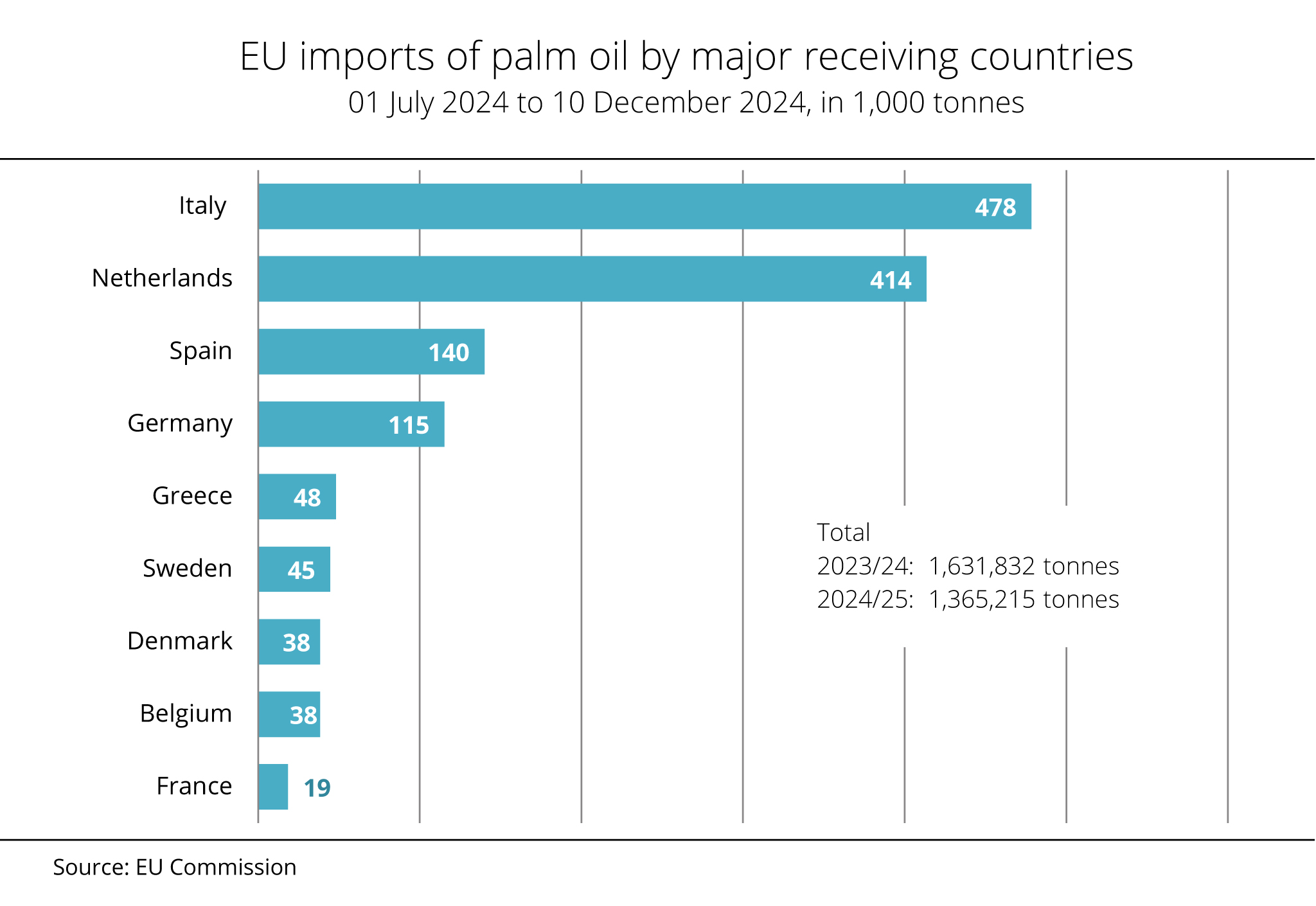

EU demand for palm oil continues to decline, as is once again confirmed by the EU Commission's import figures. The decrease is partly due to EU regulations requiring proof of deforestation-free supply chains.

In the period 1 July 2024 to 10 December 2024, the EU-27 imported just less than 1.4 million tonnes of palm oil, which represents a 16 per cent decrease on the same period in 2023. Indonesia remained the most important country of origin, exporting just under 476,000 tonnes and accounting for 35 per cent of the total, followed by Malaysia with 286,000 tonnes. In both cases, delivery volumes fell significantly short of those recorded for the period July to December 2023. Italy imported the largest volume, increasing its imports 8 per cent to 478,000 tonnes. The Netherlands, the central hub for onward export to other member states, was the second largest importer. However, it should be noted that the country is also a key location for European biofuel production. Palm oil imports to the Netherlands dropped 11 per cent compared to the previous year to 414,000 tonnes.

Spain recorded the sharpest decline, more than halving its imports to 140,000 tonnes. Sweden's imports decreased around 39 per cent. On the other hand, several other EU member states increased their imports. According to research by Agrarmarkt Informations-Gesellschaft (mbH), these countries include Greece, France, Denmark, and Germany. Receiving 115,000 tonnes, Germany recorded a 32 per cent rise in palm oil imports compared to the same period the previous year.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has pointed out that growing imports of waste oils have displaced the corresponding volumes of palm oil virtually in all member states. The association has noted that the extensive imports of waste oils are also viewed critically because they could also come from palm oil. In other words, supporting the use of waste oils also leads to a pull effect for palm oil. Because of this, the RED II provides for a 1.7 per cent cap on waste oil-based biofuels (ANNEX IX, Part B of the RED II). In Germany, the limit has been set at 1.9 per cent with the approval of the EU Commission. According to the UFOP, this cap is being circumvented by the incentive of double counting waste oils outlined in Part A of Annex IX. The ensuing incitement to committing fraud has sparked a debate on tightening certification and monitoring requirements. The UFOP has called on the new German government, which will be elected next year, to reconsider and reform this incentive to create a steering instrument that promotes domestic bio-methane production. The association argues that double counting will then benefit domestic agriculture rather than biodiesel producers in Asia.

Chart of the week (50 2024)

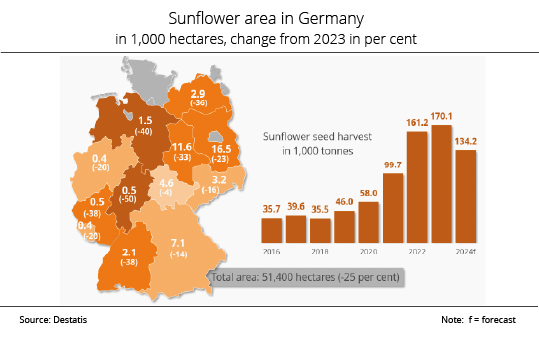

Area under sunflowers declined

In view of a significant decline in area planted with sunflowers, Germany's sunflower harvest is expected to fall short of the previous year's figures. The higher yields can only help mitigate the reduction in output.

According to preliminary information by the German Federal Statistical Office, German farmers harvested around 134,200 tonnes of sunflower seed in 2024. This was down just over 21 per cent on the previous year. The decline is mainly based on a 25 per cent decline in production area compared to the previous year to 51,400 hectares. According to research by Agrarmarkt Informations-Gesellschaft (mbH), all German federal states recorded reductions, with Hesse and Lower Saxony seeing the sharpest declines. Brandenburg remains the leading sunflower seed producing state in Germany, with 16,500 hectares under sunflowers despite a 23 per cent drop from the previous year.

The expected yield increases did not fully offset the substantial reduction in area planted. Yields are estimated at 26.1 decitonnes per hectare, nearly 6 per cent higher than the previous year. The main factors driving this increase were sufficient rainfall and mild temperatures during the summer, and relatively dry conditions at harvest time.

For many years, the sunflower area in Germany hovered around 20,000 to 22,000 hectares. However, in the wake of the Russian war against Ukraine, it expanded to a record 86,000 hectares. From the perspective of the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP), the reduction in sunflower area is understandable because the temporarily overheated producer prices have dipped back to normal levels and farmers have increasingly switched back to winter-planted crops with expected higher contribution margins. Nevertheless, this year's level reflects farmers' growing interest in producing this summer crop. To stabilise this development, traders and processors need to offer medium-term production and delivery contracts. Increased consultation efforts and the implementation of demonstration projects could also help push this development forward. According to the association, this is the only way to establish the sunflower market in Germany at a permanently higher level.

Chart of the week (49 2024)

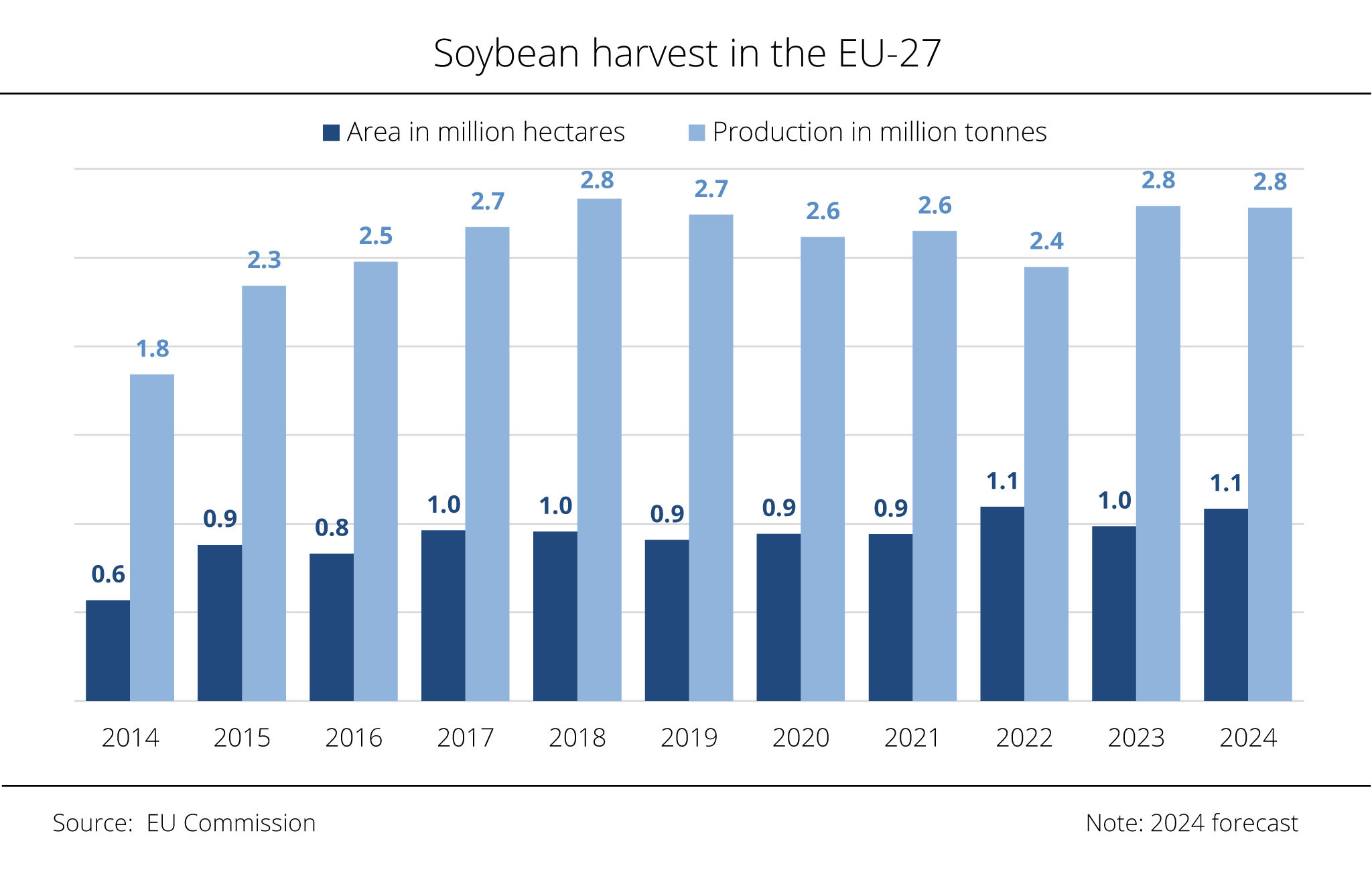

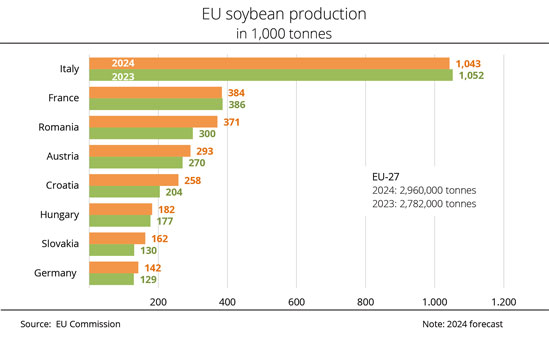

EU soybean harvest just below previous year

An updated estimate by the EU Commission suggests that this year’s soybean harvest in the EU-27 fell slightly short of the previous year's level, despite an expansion in the production area for the 2024 harvest. The decrease primarily reflects a decline in harvest in Romania.

In its latest estimate, the EU Commission marginally lowered its forecast for soybean production in the EU. The Commission put the 2024 soybean harvest at just under 2.8 million tonnes, which is down 10,000 tonnes on the previous year despite a 10 per cent increase in production area. The key reason for the decline was lower yields due to unfavourable growing conditions throughout the year. The EU average yield of 25.7 decitonnes per hectare not only fell short of the previous year's result of 28.3 decitonnes per hectare but was also shy of the long-term average of 28.1 decitonnes per hectare.

The Balkan states, especially Romania, recorded the sharpest declines in yield. In Romania, drought conditions led to a 44 per cent slump to 171,000 tonnes compared to the previous year, despite a nearly 10 per cent increase in acreage. Hungary's soybean output is estimated at 260,000 tonnes, representing a 50 per cent rise year-on-year. However, considering the doubling of the country's production area, this result also remains below expectations.

According to research by Agrarmarkt Informations-Gesellschaft (mbH), Italian farms produced 1 million tonnes of soybeans, almost 5 per cent less than in 2023. Nevertheless, Italy remains the number one soybean producer in the EU, notwithstanding an almost 3 per cent reduction in soybean area compared to the previous year.

Chart of the week (48 2024)

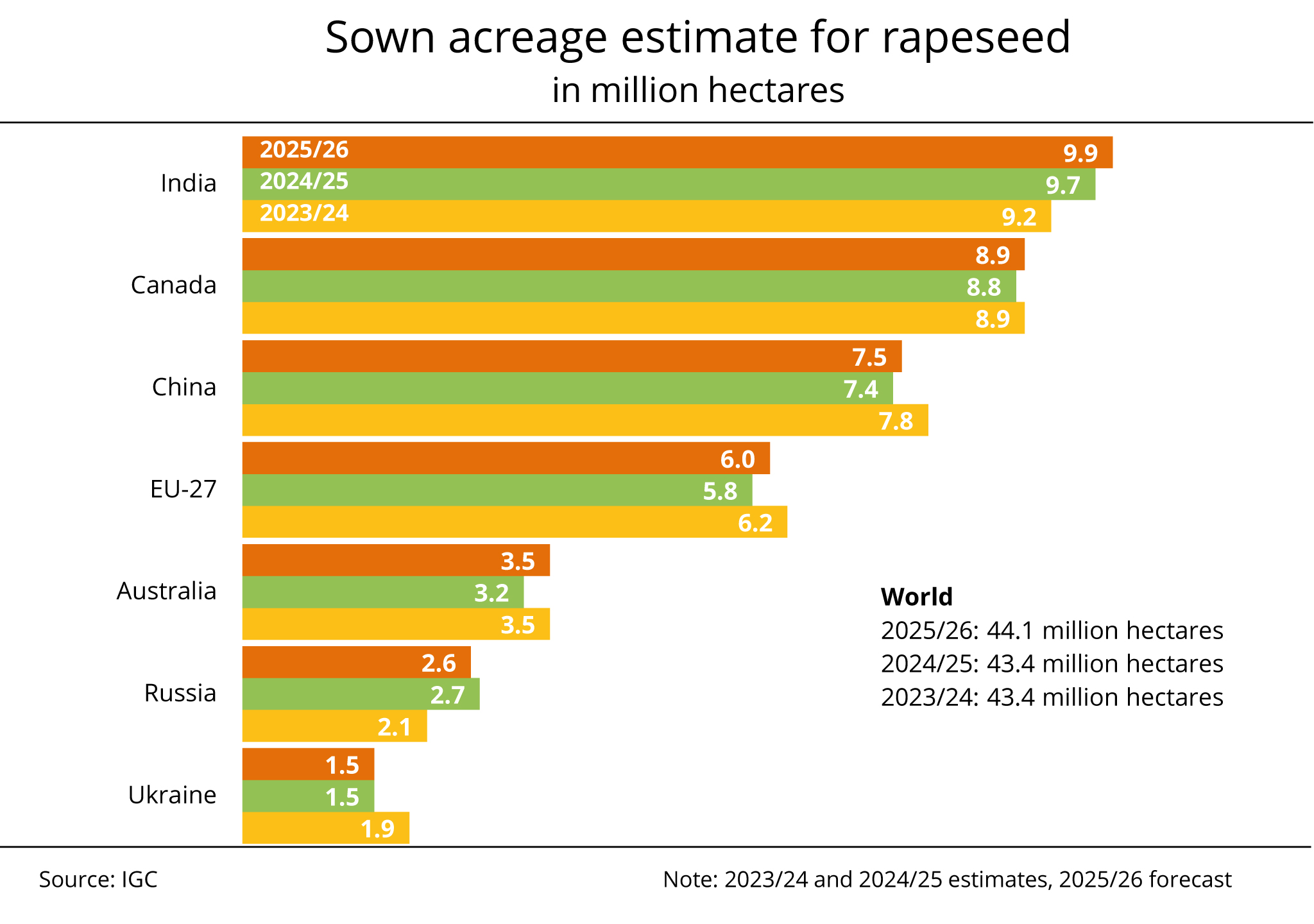

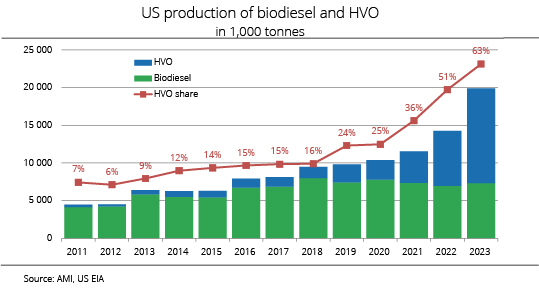

IGC projects marginal increase in global rapeseed area for the 2025 harvest

Whereas the rapeseed area in Russia is expected to decline, acreages in the EU-27, Australia, Canada, India, and the US are likely to record increases.

In its latest estimate, the International Grains Council (IGC) has forecast the global rapeseed area for the 2025/26 marketing season at 44.1 million hectares. This translates to a 1.4 per cent rise compared to the current season and would be the largest rapeseed area on record. The EU's output available for the 2024/25 season was significantly limited due to reductions in area and disappointing yields. EU farmers are now anticipated to have expanded their production areas nearly 4 per cent to 6.0 million hectares. According to the IGC, the expansions are mainly driven by attractive prices. Recent reports from Germany suggest that rapeseed stocks are generally in good condition despite strong autumn rains in some regions and dry spells in Eastern Germany at the time of sowing. Only a small fraction of the land required re-sowing.

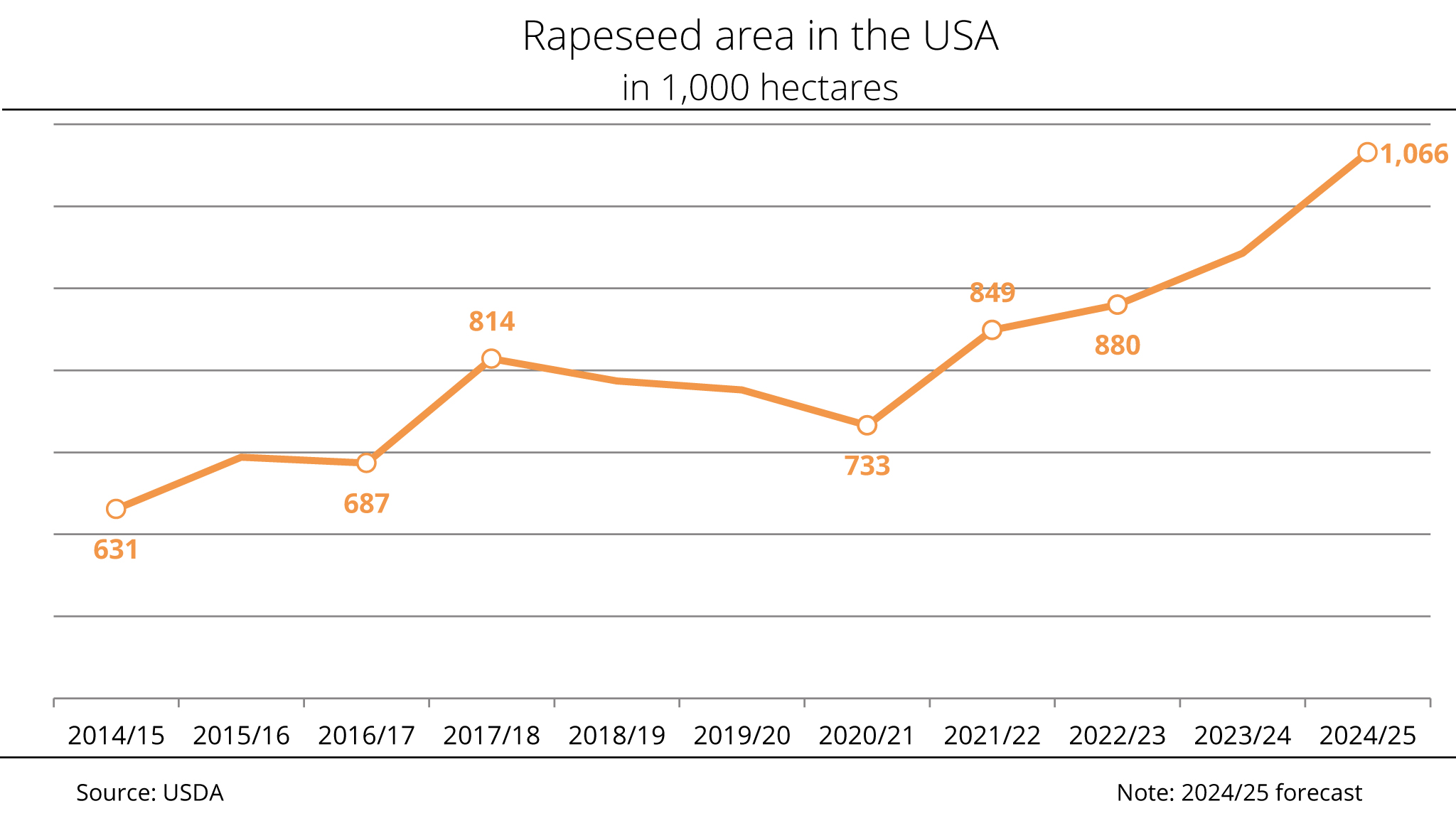

The outlook for rapeseed production in the major exporting nations is currently still uncertain. In India, conditions for sowing and germination in the country's most important rapeseed producing region Rajasthan are defined by drought. What is more, the rapeseed area has declined an estimated 7.2 per cent, falling to 3.12 million hectares. In Canada and Australia, sowings will not start for several months. Current expectations suggest expanded production areas in both countries – provided demand remains steady. In the US, an 8.3 per cent increase in rapeseed area is also considered possible. According to research by Agrarmarkt Informations-Gesellschaft (mbH), the rise would be based on growing demand from the fuel sector as a consequence of the US Environmental Protection Agency's (EPA) decision to promote biofuels for road and air traffic. In mid-2024, the EPA approved the use of rapeseed oil as a feedstock for biofuels production, which approval has led to a strong rise in rapeseed imports.

Chart of the week (46 2024)

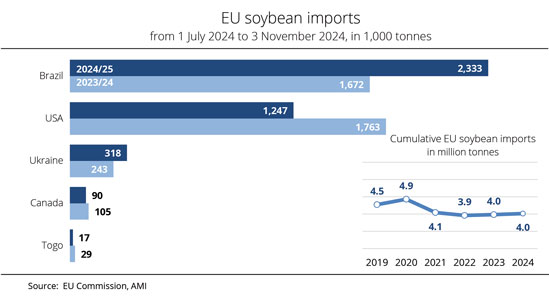

Brazil leads in EU soybean imports

Soybeans are the most important oilseed crop imported by the European Union, ahead of rapeseed. In the first four months of the current crop year, the EU imported the highest volume of soybeans since 2021/22.

According to information published by the EU Commission, the EU purchased just over 4.0 million tonnes of soybeans between July and early November 2024. This translates to a rise of around 70,000 tonnes from the same period in the season 2023/24. Brazil and the US remained the main soybean suppliers, with Brazil significantly increasing its delivery volumes. Specifically, the EU received 2.3 million tonnes of soy from Brazil in the first four months, up from 1.7 million tonnes in the previous year, raising Brazil's share of imports to 57.9 per cent. In other words, Brazil is by far the most important country of origin for soybeans for the EU. The main reasons for this key role are competitive pricing and abundant feedstock availability.

During the same period, EU imports from the US amounted to 1.2 million tonnes, around 516,000 tonnes less than the previous year, reducing the US share of imports to 31 per cent. Imports from Canada also declined, whereas Ukraine increased its soybean volumes on the EU market. The impending introduction of the EU Deforestation Regulation (EUDR) led importers to place plenty of orders for meal in the first few months of the marketing year to stockpile supplies.

Chart of the week (45 2024)

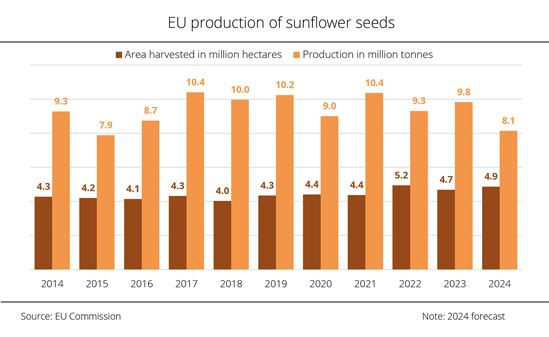

EU Commission expects smallest EU sunflower seed crop in nine years

Poor weather conditions in 2024 have considerably reduced sunflower yields across the EU. Notwithstanding an expansion in production area, total output remains well below previous years.

According to EU Commission estimates, EU sunflower seed production in 2024 amounts to just over 8.1 million tonnes. This represents a 17 per cent drop from 2023 and also the smallest harvest since 2015. Although the sunflower area increased 4 per cent to 4.9 million hectares, the expansion did not offset the 20 per cent yield decline to 16.7 decitonnes per hectare. These lowest yields seen in 12 years are due to the unfavourable weather conditions throughout the growing season.

Romania remains the most important production region in the EU-27 with a record 1.3 million hectares planted with sunflowers. However, the country's output of 1.2 million tonnes falls far short of the previous year's 2.0 million tonnes. According to research by Agrarmarkt Informations-Gesellschaft (mbH), production in Germany declined for the second consecutive year in 2024. Nevertheless, the area planted with sunflowers remains well above the level recorded before Russia's attack on Ukraine. In the wake of the attack, many farmers in Germany had expanded their sunflower areas significantly in 2022.

Abundant rainfall recently also fuelled concerns over the yield potential in France. The EU Commission recently projected just under 1.8 million tonnes, which would be a 14 per cent drop from 2023.

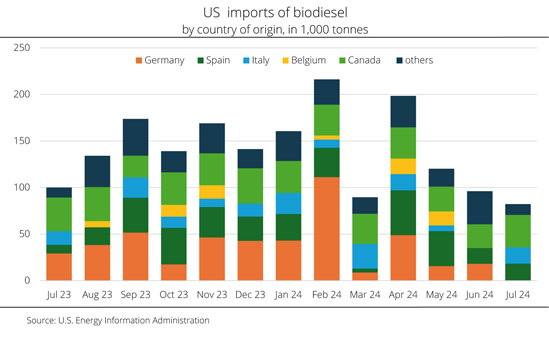

Chart of the week (44 2024)

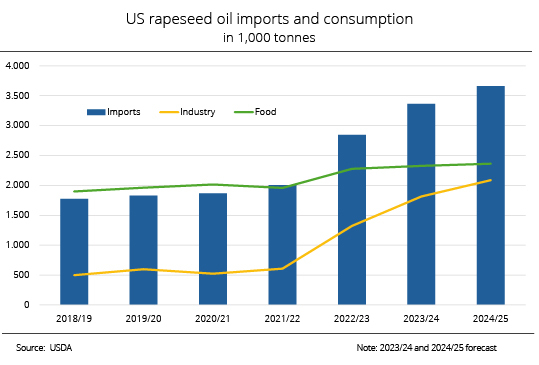

Germany is a leading biodiesel supplier to the US

US biodiesel imports have been plentiful over the past few months. Since 2022 import volumes have even doubled. Given the attractive price level, EU origins in particular have dominated.

Germany produces significantly more biodiesel than any other EU member state and consequently plays a vital role in supplying the US. This significance is reflected in US import figures. The amount of biodiesel Germany supplied in February 2024 is especially noteworthy, accounting for just under 58 per cent of total shipments. However, import volumes from Germany declined as the year progressed.

Notwithstanding robust imports and growing competition from renewable fuels, US biodiesel fuel production also increased 5 per cent year-on-year to 5.6 million tonnes in 2023. Consequently, biodiesel consumption in 2023 reached its highest level since 2017. Nevertheless, the U.S. Energy Information Administration expects US biodiesel production to decrease in the current year.

Chart of the week (43 2024)

Grains Council expects increase in canola exports from Canada

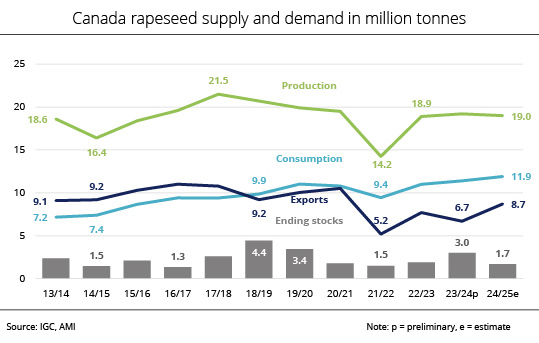

The Canadian canola harvest for 2024 is expected fall just short of the previous year's level. With rising consumption and strong export demand, ending stocks are likely to decrease notably.

According to recent information by the International Grains Council (IGC), Canada's 2024 canola harvest amounts to 19.0 million tonnes. This would translate to a 1 per cent decline from 2023. In September, the US Department of Agriculture anticipated a harvest of 20 million tonnes. The revised estimate is likely based on a slightly smaller production area and lower yields. Favourable weather conditions in late September and early October expedited the progress of harvest operations. Most of the crop has already been collected.

Canada and the EU-27 are the world's leading producers of canola and rapeseed, each producing approximately 20 million tonnes per year. In the current season, the EU relies more on imports to supply its oil mills, including from Canada, due to a smaller harvest.

With Canadian domestic consumption slightly rising to 11.9 million tonnes, the country will have a surplus of 7.1 million tonnes. Nevertheless, stocks are projected to drop to 1.7 tonnes, well below the 3.0 million tonnes recorded the previous year. The decline is primarily attributed to an expected increase in exports. According to research by Agrarmarkt Informations-Gesellschaft (mbH), Canada is set to ship 8.7 million tonnes of canola across the world's oceans, almost 30 per cent more than in 2023/2024. The main reason for this increase is fairly tight global supply, as availability of rapeseed from Ukraine and Australia, the other major rapeseed exporting countries, is reduced. However, the use of Canadian rapeseed in the EU is restricted because of its genetically modified varieties. This makes the biofuels market the most important trade channel for Canadian canola oil.

Chart of the week (42 2024)

Plentiful rapeseed imports to the EU

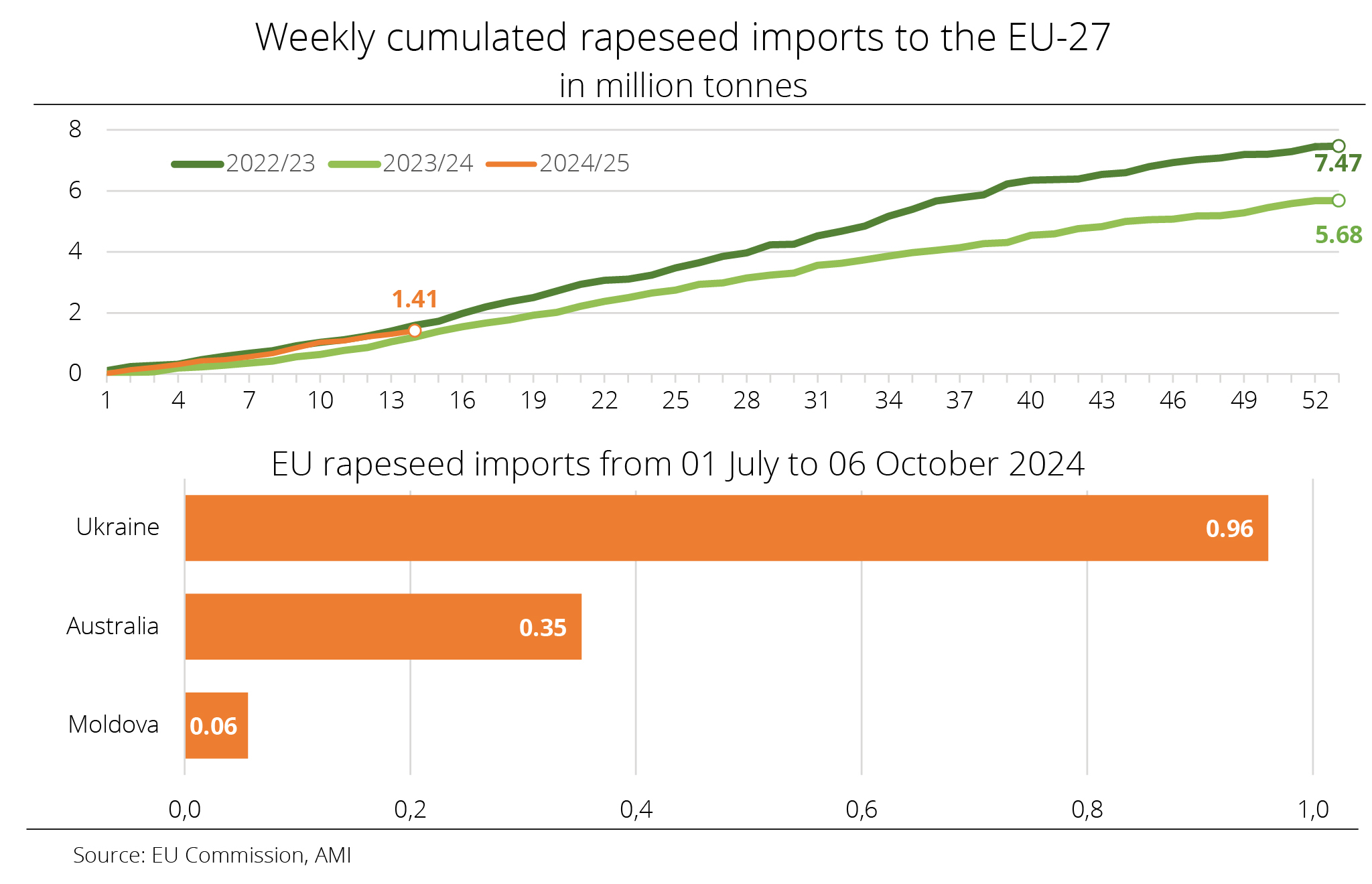

In the first quarter of the running crop year, rapeseed imports to the EU exceeded those of the same period last year. Just over two thirds of those imports came from Ukraine.

Between the beginning of the crop year and 6 October 2024, EU-27 imports of rapeseed amounted to 1.41 million tonnes, which represents an increase of just over 17 per cent on the previous year. The imports are used to supplement supply from EU production. Demand for imports is high this season due to the sub-standard 2024 harvest.

Ukraine remains the most important country of origin, supplying 960,400 tonnes. This translates to a 68 per cent share of imports and a 60 per cent increase from the previous year's 599,400 tonnes. However, according to Agrarmarkt Informations-Gesellschaft (mbH), Ukraine is unlikely to sustain this export volume in the coming months. This expectation is based on the 25 per cent harvest decline compared to the previous year, which severely curtails the country's export potential. Australia is the EU's second most important rapeseed supplier, delivering 351,800 tonnes and accounting for 25 per cent of EU rapeseed imports. This translates to an increase of 3 per cent over the same period a year earlier. Moldova ranks third, supplying 56,200 tonnes. Deliveries from Moldova more than halved compared to the same time a year earlier. Most of this rapeseed likely originated from Ukraine. Canada has not supplied any significant quantity this crop year but could increase its share of imports due to its exceptionally large harvest and the loss of China as an importing country. However, the use of Canadian rapeseed in the EU is restricted because of its genetically modified varieties. This makes the biofuels market the most important trade channel for Canadian rapeseed oil.

Chart of the week (41 2024)

Decline in biodiesel use

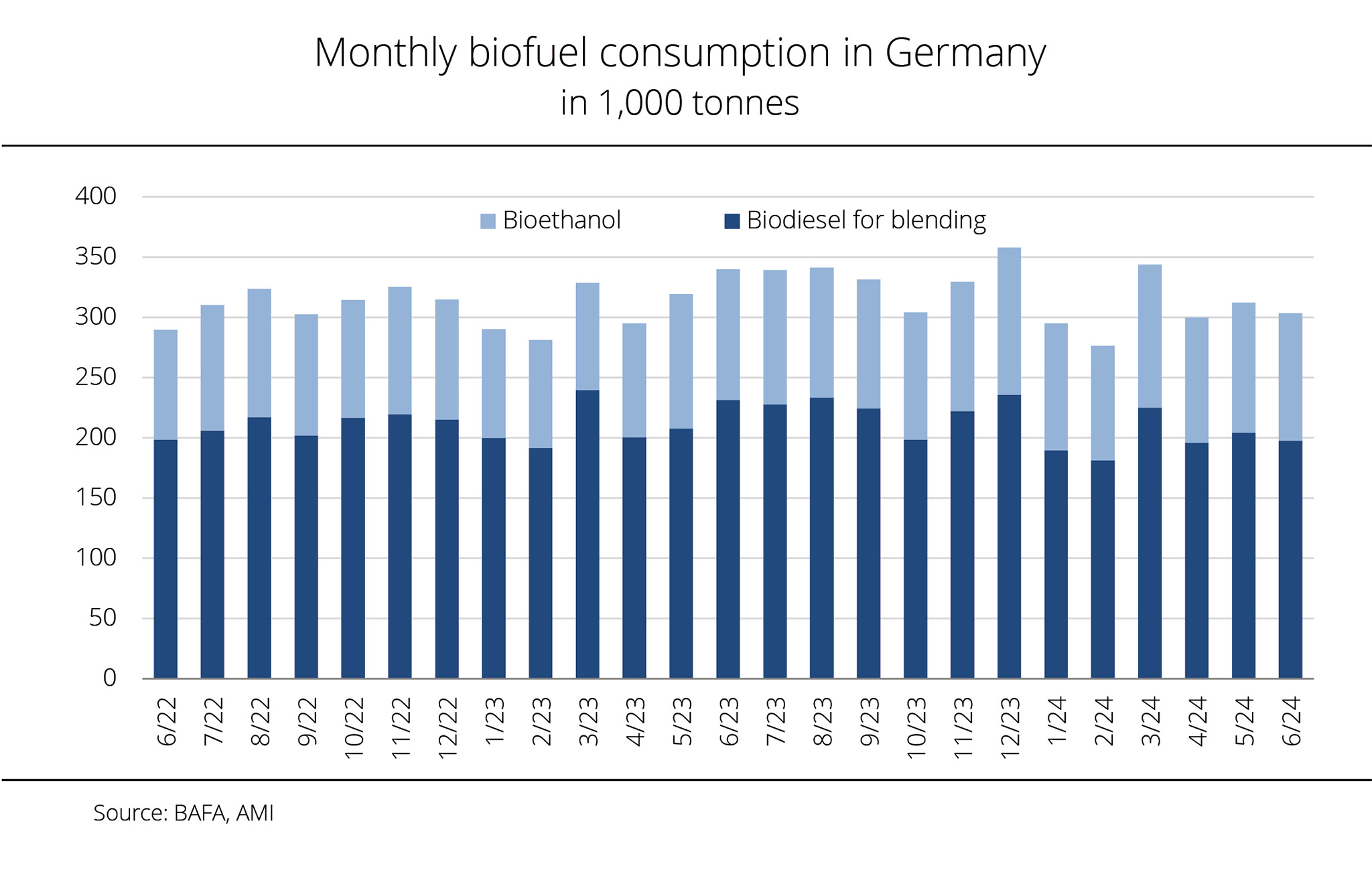

In the first half of 2024, biodiesel consumption declined sharply compared to the previous year. Bioethanol use increased during the same period.

According to the Federal Office of Economics and Export Control (BAFA), consumption of biodiesel fell by 3% to 197,700 tonnes in June compared to the previous month.

In the year-on-year comparison, the decline amounts to as much as 14.6 per cent. Consumption of diesel reached a volume of 2.5 million tonnes in June 2024, up 4.7 per cent on the previous month, while remaining 3.6 per cent below the previous year's volume. As a result, the incorporation rate dipped significantly to 7.4 per cent, a level below the half-year average and clearly below the rate of 8.3 per cent recorded in June 2023. In the first half of 2024, the use of biodiesel for blending amounted to around 1.2 million tonnes, down 7.0 per cent from the same period in 2023. Consumption of B7 diesel fuel reached just over 14.2 million tonnes, falling almost 5 per cent short of the previous year's volume. Consequently, according to research by Agrarmarkt Informations-Gesellschaft (mbH), the average incorporation in blends dropped 0.2 percentage points to 7.7 per cent compared to the year-earlier period.

The use of bioethanol also declined in June 2024. At 105,800 tonnes, consumption was down 2.1 per cent on the previous month. Bioethanol use in blends decreased 3.3 per cent, although it remained 3.0 per cent above the level recorded in June 2023. On the other hand, the use in ETBE rose 14.5 per cent month-on-month, while falling 40.4 per cent compared to June 2023. Overall, the use of bioethanol in the first half of the year totalled 636,400 tonnes, exceeding the previous year's volume by just about 8.3 per cent. During the same period, petrol consumption rose 0.7 per cent. As a consequence, the incorporation rate increased 0.5 percentage points to 7.4 per cent.

In light of these trends, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) expects sales of biodiesel and HVO in Germany to continue their downward trajectory. The association has projected overall demand for 2024 at 2.4 million tonnes, equivalent to the biodiesel and HVO sales volume in 2019. That year, legislation stipulated a greenhouse gas quota obligation of 4.0 per cent (2024: 9.35 per cent), but it did not allow for the option to double or triple count biofuels from specific waste oils and for e-mobility purposes. Nor was it possible to offset UER certificates, which are suspected of being fraudulent.

Making reference to the planned revision of greenhouse gas quota obligation legislation and redefinition of the annually increasing quota requirements, the UFOP has called for an ambitious increase of the greenhouse gas quota obligation to compensate for multiple crediting and the necessary increase in the proportional share of e-mobility in transport performance. Since the diesel fuel standard caps the incorporation of biodiesel at 7 per cent by volume and the market for B10 is not accessed through public petrol stations, the forthcoming amendment of legislation should go along with the development of a fuel strategy that, in particular, starts off the use of biodiesel in heavy goods vehicles. Without such strategy, the UFOP fears that German biodiesel producers may have to export more of their output, giving away greenhouse gas emission reduction potential to other member states. The UFOP therefore regards Federal Minister of Transportation Volker Wissing's one-eyed focus on paraffinic fuels as inappropriate. Emphasising the bridging function of biofuels from cultivated biomass in particular, the UFOP has stressed the need for a comprehensive strategic approach that includes all compliance options.

Chart of the week (40 2024)

German soybean harvest down from previous year

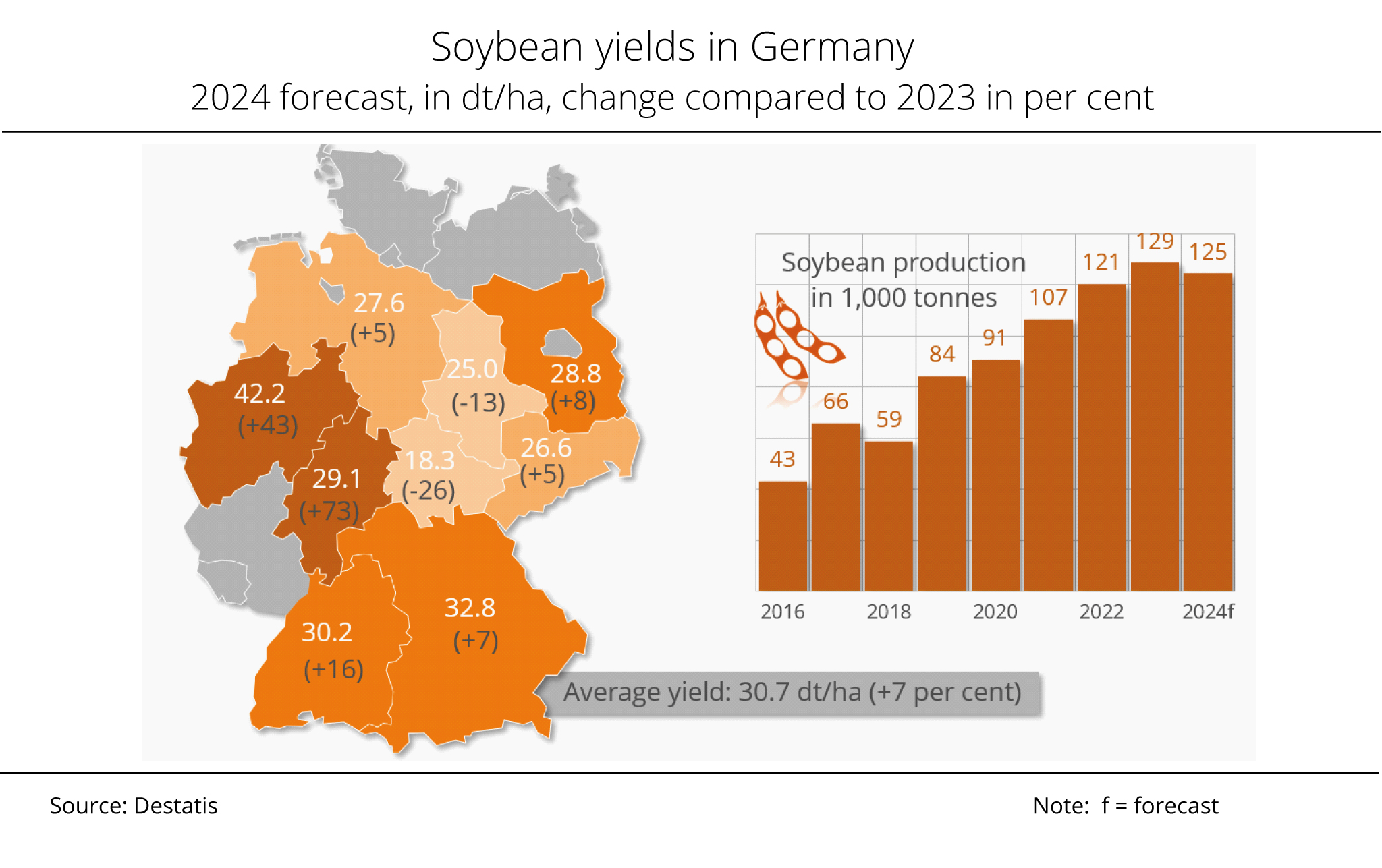

In view of a significant reduction in area, the 2024 soybean harvest will probably fall short of the previous year's output. However, the decline will be partially offset by increases in yield.

According to Agrarmarkt Informations-Gesellschaft (mbH), soybean farming did not play an appreciable role in Germany until 2015. Since then, the area has grown continually and significantly. However, in 2024, it has been reduced good 9 per cent to 40,600 hectares.

According to preliminary information by the German Federal Statistical Office, 124,500 tonnes of soybeans were probably harvested from the significantly reduced area, around 4,500 tonnes less than the previous year. Consequently, yields are likely to exceed the previous year's level. Soybean yields will presumably reach on average 30.7 decitonnes per hectare, representing a just under 7 per cent rise compared to the previous year. Only Thuringia and Saxony-Anhalt are expected to experience lower yields. Bavaria and Baden-Wuerttemberg are anticipated to remain the most important production regions.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has underlined the remarkable substitution potential of German or EU-grown soybean, given Germany's immense demand for imports. In 2023, soybean imports reached 3.4 million tonnes, of which approximately 2.7 million tonnes came from the USA. The strong demand for higher-protein feedstuff opens up opportunities for sales and increases in area under cultivation of locally grown soybeans and grain legumes, as well as rapeseed meal from rapeseed processing. From the perspective of the UFOP, legumes are crucial crops in resilient crop rotations geared to climate change mitigation and should play a key role in the future design of the Common Agricultural Policy (CAP) when it comes to justifying transfer payments by societal benefits.

Chart of the week (39 2024)

Canola production in the US is booming

The US biofuel market is experiencing dynamic growth, making canola cultivation increasingly attractive for farmers in the northern US. Their Canadian counterparts are also benefiting, because the US is a major market for both canola meal and oil.

Canola cultivation in the US is on the rise. According to the US Department of Agriculture (USDA), the area dedicated to canola exceeds 1 million hectares for the first time in the 2024/25 season. This represents a 13 per cent increase from the previous year. If yields remain consistent with the previous season, the USDA expects a record harvest of just over 2.1 million tonnes. This would position the US as a globally significant producer of canola and rapeseed. All of the key canola-producing states in the US have expanded their cultivation areas. North Dakota accounts for the lion's share of 830,000 hectares. The state is followed by Montana and Washington, each with around 80,000 hectares, and Idaho and Minnesota, each with about 38,000 hectares. Notably, the canola areas in North Dakota, Montana and Washington have all risen to record highs.

According to research by Agrarmarkt Informations-Gesellschaft (mbH), the growth of canola production in the US is driven by dynamic demand for meal as feed for dairy production and for canola oil as a key feedstock for biofuel production. In particular, the Renewable Fuel Standard (RFS) at the national level and the Low Carbon Fuel Standard (LCFS) in California, where more than 50 per cent of transport fuels are now biobased, have led to brisk demand and attractive prices for producers. However, despite this growth, US production cannot keep pace with demand. Consequently, US imports of canola meal and oil, primarily from Canada, continue to increase steadily.

Chart of the week (38 2024)

USDA expects four-year low for sunflower seeds

According to the latest forecast by the US Department of Agriculture (USDA), the sunflower seed harvest is set to decline worldwide. In particular the EU-27 and Ukraine are seen to bring in smaller harvests.

In the current USDA forecast for 2024/25, global sunflower seed production is estimated at 50.6 million tonnes, much lower than the August forecast of 52.5 million tonnes. This would represent the smallest harvest in four years. Consequently, supply is seen to drop 5.3 million tonnes compared to the previous year.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the revision is mainly due to anticipated smaller harvests in the EU-27 and Ukraine. For the EU, the USDA projects production at 9.5 million tonnes, around 650.000 tonnes lower than the previous estimate and 500,000 tonnes less than the 2023 harvest. The revision reflects both the reduction in production area and loweryields. Ukrainian production is expected to reach 12.5 million tonnes. In other words, the USDA lowered its forecast 1 million tonnes on the previous month based on the persistent drought and heat waves over the past few months, which have likely reduced the yield potential.

The forecast for Russian production remained unchanged from August at 16.0 million tonnes, only around 1.1 million tonnes less than in 2023/24. This means that the country is set to remain the world's most important supplier of sunflower seeds.

Chart of the week (37 2024)

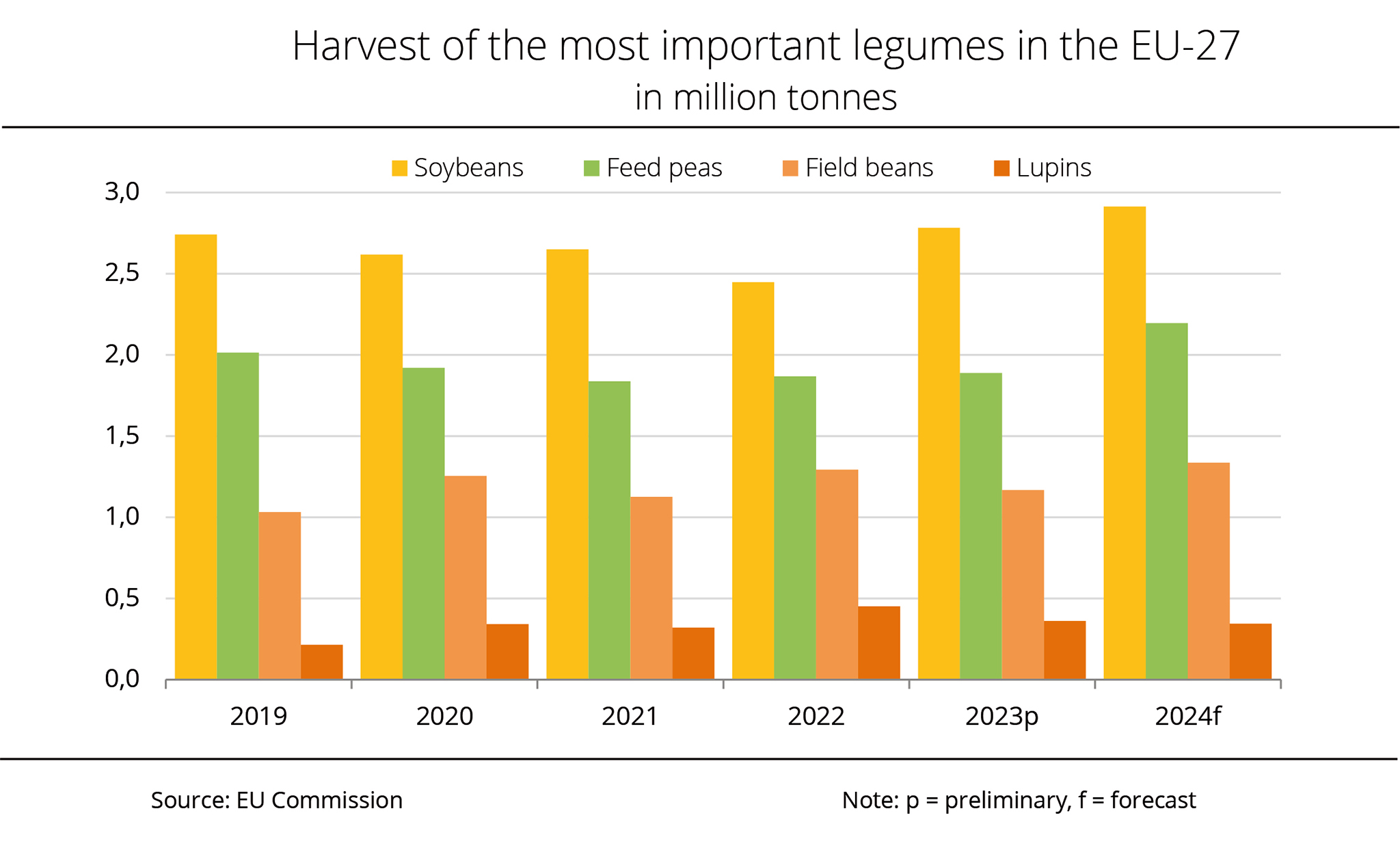

EU Commission expects seven-year high for legumes in Europe

According to the EU Commission, EU output of legumes from the 2024 crop is set to exceed the previous year's figure by 10 per cent and also surpass the average of the past five years. Feed peas and field beans are set to see the biggest increases.

According to the figures published by the Commission, the legume harvest throughout the EU will likely reach just under 6.8 million tonnes in 2024. This would translate to a 10 per cent increase on the previous year. It would also fall just short of the 6.9 million tonne bumper harvest recorded in 2017 (EU-28). Above all, the harvest of feed peas will presumably grow 16 per cent compared to the previous year to 2.2 million tonnes. According to Agrarmarkt Informations-Gesellschaft (mbH), the rise is due to both the expansion in area planted and presumed yield increases.

At 2.9 million tonnes and accounting for 43 per cent of the total legume crop, soybean remains the most important legume in the EU. Despite lower yields, output is seen to increase 5 per cent year-on-year. This would be the largest harvest on record. The hectarage of field beans was also expanded. The EU Commission estimates EU output at 1.3 million tonnes, representing an around 14 per cent rise compared to the previous year. On the other hand, the EU sweet lupin harvest is expected to remain below the previous year's output of 362,000 million tonnes, at 345,000 million tonnes.

The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) has noted that the development of legume production confirms farmers' fundamental interest in maintaining or even expanding the cultivation of legumes. However, the association has criticised that the benefits this type of crop has for biodiversity and climate change mitigation are not properly and appropriately priced in. In short, for corresponding crop rotation planning, the production of grain legumes must pay off in the long term to prevent the repeatedly expressed political call for more resilience in arable farming from coming to nothing. The UFOP has welcomed initiatives by the German Federal Ministry of Agriculture to promote the production of grain legumes as a contribution towards enhancing the added value, adding that such action should also benefit farmers. In view of the ongoing negotiations on the budget of the German Federal Ministry of Agriculture in the German Bundestag, the UFOP has called on those responsible to make the accompanying and incentive measures relating to the protein crop strategy sufficiently attractive in order to support this fundamentally positive development.

Chart of the week (36 2024)

German biodiesel exports hit record level

Foreign trade in biodiesel is set to be brisk in 2024. More specifically, German exports in the first six months rose just less than 16 per cent on the year-earlier period, whereas imports even increased as much as 24 per cent. Nevertheless, the export surplus grew to 0.76 million tonnes (previous year 0.72 million tonnes). From the perspective of the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP), these exports are an extremely important outlet to ease the pressure on the rapeseed oil and biodiesel markets. They keep the oil mills working at full capacity and secure market supply with rapeseed meal as a protein source. However, the UFOP has stated that the excess of exports could also have been used to decarbonise the transport sector in Germany.

According to figures published by the German Federal Statistical Office, Germany exported around 1.7 million tonnes of biodiesel in the first half year of 2024. On the other hand, imports amounted to 906,719 tonnes. The Netherlands continued to be the primary trading partner, accounting for 47 per cent and 52 per cent of total exports and imports respectively. The import volume increased for the third consecutive year. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), larger supplies also came from Malaysia and Belgium, whereas imports from Poland, Finland and Austria fell short of the previous year's volumes.

The main recipient countries of German biodiesel also were EU countries, headed by the Netherlands, Belgium, Poland, Austria and France. The most important non-EU country was the US, although US imports dropped around 46 per cent to just under 131,000 tonnes in the first half year of 2024.

Chart of the week (35 2024)

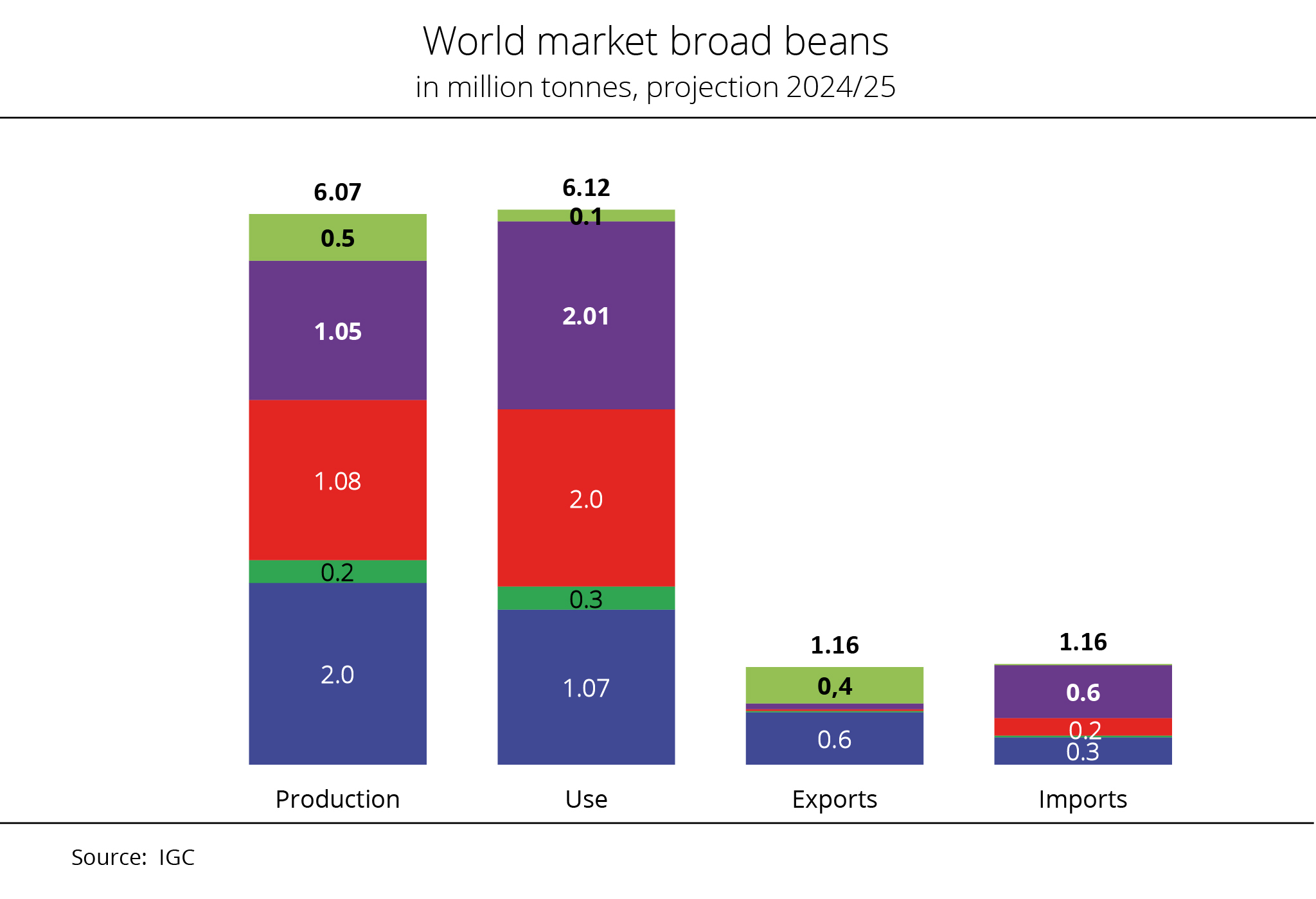

International Grains Council (IGC) does not expect any changes in global broad bean production

The global broad bean market is set to recover only slightly in 2024/25 following the 2023 slump in production, which also limited consumption.

Broad beans are a niche product on the world market. With global production amounting to around 6 million tonnes, supply is still relatively small compared to 484 million tonnes of soybeans or 20 million tonnes of a chickpeas. The EU has the largest share of the global broad bean market – and Germany in turn has the largest share within the EU.

For the running 2024/25 marketing year, the International Grains Council (IGC) expects worldwide production to increase 1 per cent to 6.1 million tonnes, mainly due to the foreseeable larger European harvest of 2 million tonnes. The expectation is based on a larger production area and higher yields. The IGC sees EU production at a seven-year high, up 1.3 million tonnes or 15 per cent on the previous year's volume. Broad bean output in the UK is expected to drop 7 per cent or 0.6 million tonnes, because the area has been significantly reduced. Australia is also anticipated to see a decline in harvest compared to 2023 (minus 7 per cent to 0.5 million tonnes). However, in this case the reason is lower yields. The expectation for Asia, with China as the main producer, remains at 1.8 million tonnes. African production is also seen to remain stable at 1.5 million tonnes, with Ethiopia, Sudan and Egypt contributing the largest share.

Following the 1.6 per cent decline in consumption in 2023/24, demand is expected to remain unchanged at 6.1 million tonnes in the current marketing year, according to research by Agrarmarkt Informations-Gesellschaft (mbH). In terms of consumption, Europe ranks third behind Africa (2.1 million tonnes) and Asia (2 million tonnes), consuming 1.7 million tonnes. Consequently, ending stocks are likely to decline for the fourth time running, reaching the mark of 672,000 tonnes in 2024/25. This compares to 817,000 tonnes in 2022/23.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) sees the gradual development of the production of broad beans and large-grained pulses such as pea, lupin and soybean in Germany and the EU, in the medium to long-term, as a major contribution towards regional supply of feed and, increasingly, also food markets. According to the UFOP, higher added value through regional farming and regional processing must "pull" the production area in the future. Legumes are an essential element of resilient and sustainable arable farming.

The UFOP has indicated that, as part of the of BMEL-funded joint project LeguNet (https://legunet.de/english), UFOP's responsibility is not only to impart knowledge about cultivation at the producer level, but also to procure the necessary collection and processing structures and help build networks.

Chart of the week (34 2024)

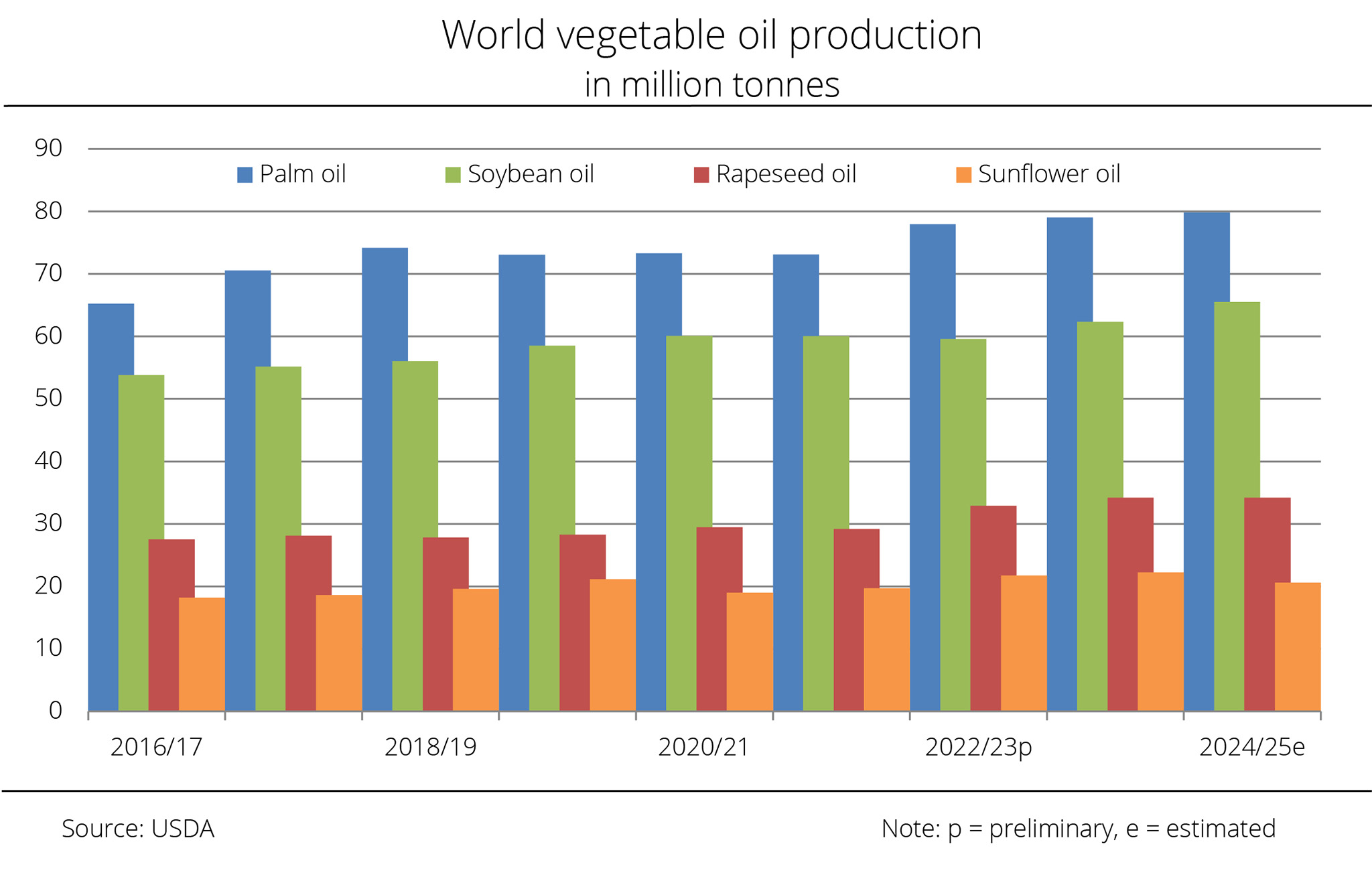

Global vegetable oil production continues to grow

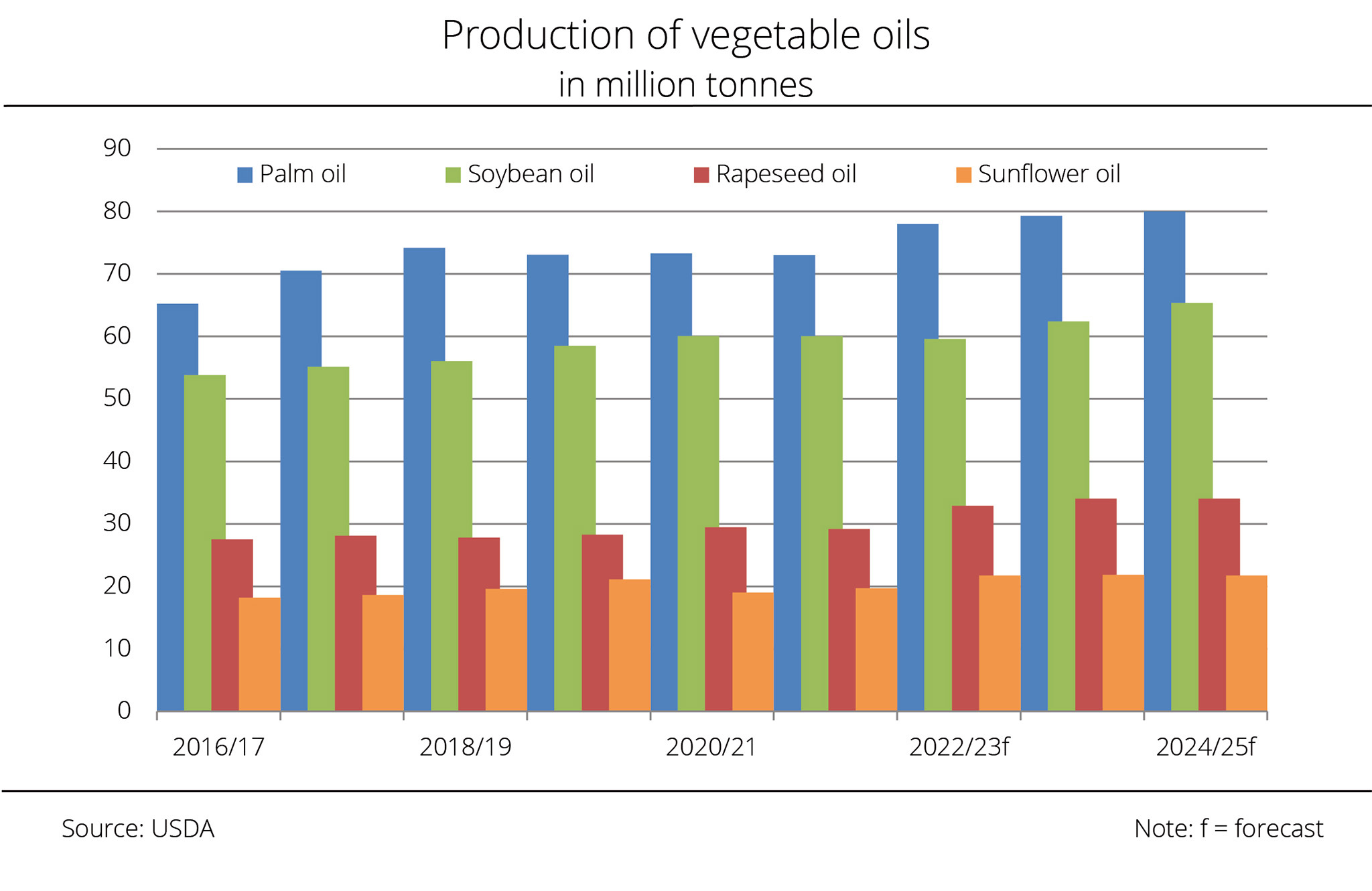

World production of vegetable oils is growing, as is demand. Especially palm and soybean oil are likely to be significantly more abundant in 2024/25, more than offsetting the decline in sunflower oil.

World production of vegetable oils is growing, as is demand. Especially palm and soybean oil are likely to be significantly more abundant in 2024/25, more than offsetting the decline in sunflower oil.

The US Department of Agriculture (USDA) expects global production of vegetable oils in the current crop year to hit a record level at 224.2 million tonnes. This would translate to a 2.7 million tonne rise year-on-year. Consumption is estimated at 221.7 million tonnes, up 5.3 million tonnes on the previous year. Against this background, ending stocks are poised be lower than the previous year at 29.6 million tonnes and also fall short of the long-standing average.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), palm oil production is set to reach yet another record volume in 2024/25. Although the USDA lowered its earlier forecast of 80 million tonnes, the currently expected 79.8 million tonnes are still up 0.8 million tonnes on the 2023/24 output. Given the ample supply of feedstock, supply of soybean oil is likely to grow just less than 3.2 million tonnes, hitting a new record at 65.5 million tonnes. Production of rapeseed oil is also set to reach a record level at 34.2 million tonnes. However, the USDA expects sunflower oil production to plummet in 2024/25, especially due to a more than 1 million tonne decline in production in Ukraine. The world forecast was lowered almost 1 million tonnes month-on-month to 20.6 million tonnes, sliding just under 2 million tonnes below the previous year's volume. This would be the lowest output since 2021/22.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has stated that global supply of vegetable oils for human consumption is fundamentally secure. The association has emphasised the important advantage that rapeseed, sunflower and soybean oil are nutritionally interchangeable in food preparation. The same applies to processed products such as fat spreads. The association has reminded of the shortages of sunflower oil at the beginning of Russia's war against Ukraine, which shortages were filled with rapeseed oil. The UFOP is concerned about the large number of military conflicts that currently exist in many regions, stressing that the resulting supply bottlenecks and famines are exclusively due to political reasons.

Chart of the week (33 2024)

Extreme heat reduces sunflower yields

Despite an expansion in area planted with sunflowers in the European Union, harvest expectations are fading. The reason is lower yields due to adverse weather conditions.

Despite an expansion in area planted with sunflowers in the European Union, harvest expectations are fading. The reason is lower yields due to adverse weather conditions.

The unfavourable weather conditions in Europe prompted the EU Commission to lower its harvest estimate for sunflower seed significantly. In the forecast published at the end of July, the harvest is expected at 10.1 million tonnes, 649,000 tonnes lower than the previous month. In other words, the harvest would exceed the 2023 level by only 316,000 tonnes or 3 per cent.

Foreseeable lower production in Bulgaria and Hungary, in particular, motivated the Commission to make this adjustment. At 1.8 million tonnes and 1.9 million tonnes respectively, the estimates are down 278,000 tonnes and 251,000 tonnes respectively on those published in June. Romania, the largest sunflower seed producer in the EU, is currently expected to harvest 2.5 million tonnes, around 147,000 tonnes less. The main factors for the declines are the persistent drought and heat waves that impair the development of the crops. Daytime highs exceeded 40 °C in some places. If the lack of rain continues, more downward adjustments can be expected.

For the 2024 harvest, sunflower seed yield is currently estimated at 20.9 decitonnes per hectare. In other words, the forecast is not just down 1 decitonne per hectare on the previous month. It also falls short of the long-term average of 21.7 decitonnes per hectare.

Chart of the week (32 2024)

EU Commission sees Germany as the biggest rapeseed producer in the EU - UFOP: estimates by the EU Commission and Deutscher Raiffeisenverband are far apart

According to latest EU Commission estimates, the EU rapeseed harvest will likely be smaller than previously expected. The main reason is the lower harvest volume in France. Many market players are putting a question mark on the expectations concerning the German crop.

The rapeseed harvest in the EU is in full swing and has already been completed in some areas. The yield reports confirm the estimates, which had already been lowered in the run-up to the harvest. The drops in yield are mainly attributable to the unfavourable weather prior to flowering – a critical phase for crop development and therefore yield production – and pest pressure after emergence in many parts of the EU. In the light of this, the EU Commission lowered its crop forecast several times. According to recent information, the EU rapeseed harvest is likely to amount to just under 18.4 million tonnes, which is down just less than 0.5 million tonnes on the June forecast and down as much as 1.3 million tonnes on the 2023 harvest. Nevertheless, the long-term average of 17.8 million tonnes is set to be outpaced. The International Grains Council (IGC), forecasting 18.5 million tonnes, is slightly more optimistic, as is the USDA with its forecast of 18,9 million tonnes.

The main reason for the scale-down is a presumably smaller harvest in France. The Commission is currently forecasting 3.9 million tonnes, which compares to 4.1 million tonnes expected in June. In other words, this year's production will fall far short of the previous year's output of 4.3 million tonnes. Exceptionally high rainfall in the first half of the year affected the development of the crops and thus also significantly limited the yield potential.

The forecast of Romanian rapeseed production was also revised downwards. At just less than 1.5 million tonnes, the Commission projects the harvest just under 0.1 million tonnes lower than it did in June and as much as 0.3 million tonnes lower than the previous year's harvest. Similarly, the forecasts for Hungary, Latvia and the Czech Republic are also considerably lower compared to the previous month. Harvests in these countries also fall short of the previous year's levels. The forecast for Germany was only lowered slightly to 4.0 million tonnes, representing a significant gap over the previous year's volume of 4.2 million tonnes. Nonetheless, the EU Commission's forecast is well in excess of that of many other market partners and the latest forecast of the Deutscher Raiffeisenverband (DRV), which expects just over 3.8 million tonnes.

Only expectations for Slovakia, Ireland and Denmark were slightly raised. However, the volumes estimated by the EU Commission are still below the previous year's figures. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the somewhat higher production estimated for these countries is not sufficient to offset the significant decline in France and other countries. Rapeseed supply in the EU for the 2024/25 marketing year is set to be substantially lower than only recently expected.

Chart of the week (31 2024)

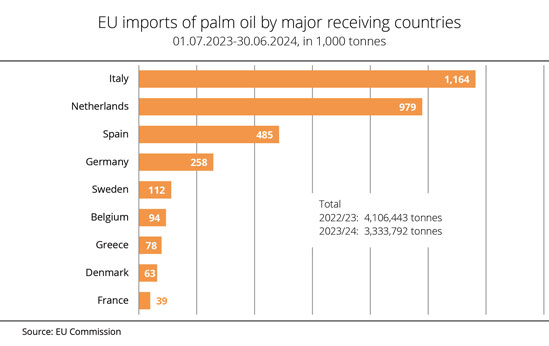

EU-27 imports less palm oil - UFOP: prohibition on crediting biofuels is effective

EU member states imported significantly less palm oil in the marketing year 2023/24 than the previous year. The decline in imports was especially strong in the Netherlands, Spain and Germany.

In the period from July 2023 through the end of June 2024, the EU-27 imported just under 3.3 million tonnes of palm oil, representing a decline of around 773,000 tonnes or 19 per cent on the year before. The main importing country in the EU was Italy, receiving 1.2 million tonnes, which was up around 40 per cent on the 2022/23 season. It was followed by the Netherlands as second most important importer with 979,300 tonnes. However, the country's imports were 19 per cent short of the previous year's volume of 1.2 million tonnes. With regard to Dutch imports, it should be noted that ports such as Rotterdam or Amsterdam are central destinations for overseas imports and serve as ports of entry into the EU from where palm oil is shipped on to other EU member states. Also, the Netherlands is an important European location for the production of biofuels.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the decline in palm oil imports to Spain was more pronounced. At 484,800 tonnes, the country's imports were around 61 per cent smaller than in the 2022/23 reference period. Belgium received 93,800 tonnes, around 7 per cent less. Germany also imported significantly less palm oil from abroad. At 257,500 tonnes, the country obtained around 28 per cent less than in the previous marketing year.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has welcomed the general decrease in palm oil imports. The association attributes this trend mainly to the decline in using palm oil as a feedstock in biodiesel fuel and hydrotreated vegetable oil (HVO) production. The reason for the decline is is that since January 2023, palm oil-based biofuels can no longer be counted towards GHG quota requirements in Germany.

At present this prohibition on crediting is undermined by palm oil-based biodiesel imports from China that were presumably re-labelled as imports of biodiesel produced from waste oils. The palm oil-based biodiesel was previously imported from Indonesia at dumping prices. The UFOP therefore welcomes the progress in the EU Commission's proceedings to consider imposing import duties against Chinese producers and traders. Specifically, the EU Commission is planning to charge import duties ranging between 12.8 and 36.5 per cent based on the CIF price (cost, insurance, freight) free EU border. These duties will affect approximately 50 biodiesel producers and traders.

Despite this provisional step by the EU Commission, the UFOP has urged that the root cause of this undesirable development be addressed to ensure fair competition by abolishing the double counting of biodiesel, HVO and CHVO (co-processed in the refinery) from waste oils in accordance with Part A of Annex IX of the Renewable Energies Directive. The association has highlighted that the problem was partly self-inflicted by the responsible authorities in the member states, as they approved the relevant waste categories.

Chart of the week (30 2024)

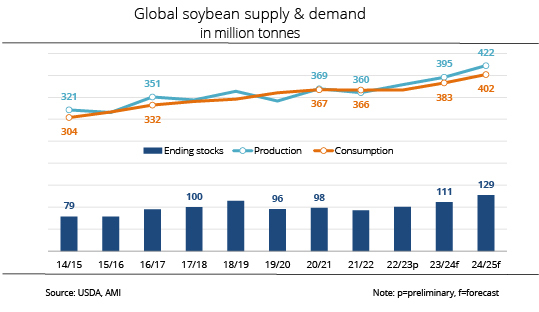

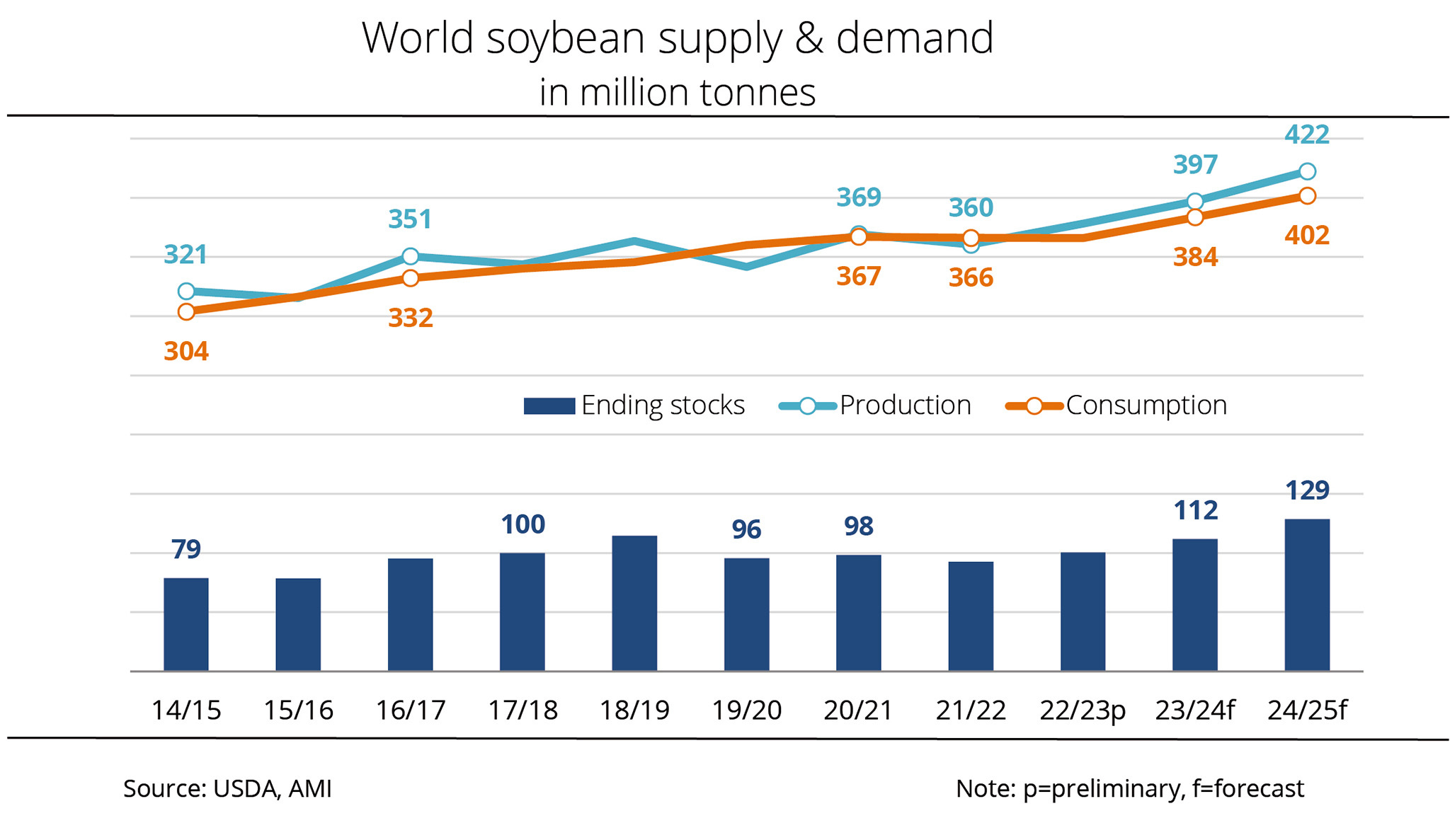

World soybean supply set to hit record high

In its latest outlook, the USDA minimally lowered the forecast for global soybean supply. Despite this adjustment, the USDA expects a bumper crop.

The US Department of Agriculture (USDA) is optimistic about global supply of soybean in the 2024/25 season. It currently anticipates production to reach 421.6 million tonnes, representing a 26.4 million tonne rise on the previous year. This suggests that more soybeans will be harvested worldwide than ever before. The latest International Grains Council (IGC) forecast of 415.1 million tonnes is below the USDA estimate. The USDA and IGC agree that production in Brazil and the US can be expected to grow. The difference between the IGC and USDA estimates is due to different projections for Brazilian production. While the IGC sees the 2025 harvest at 161.5 million tonnes, the US authority anticipates Brazilian output at just under 169 million tonnes. Both estimates are quite vague at this point, because the 2024 harvest was only recently completed and sowing for the 2025 harvest will not start for another two months. However, both the IGC and USDA anticipate an increase in area planted in Brazil due to strong local and international demand, particularly from the biofuel sector in North and South America.

Apart from that, the USDA only made minor changes compared to the previous month, according to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH). More specifically, consumption in the season 2024/25 is now forecast at 401.5 million tonnes, almost unchanged from the previous month. In other words, soybean consumption is seen to rise 19.0 million tonnes year-on-year.

The popularity of soybeans in crop rotation is likely to have increased prior to sowing due to the competitive producer prices compared to other crops. The USDA continues to see 2024/25 global ending stocks at 127.8 million tonnes, representing an increase of 16.5 million tonnes on the previous year. This means that the long-term average of 99.6 million tonnes will be significantly exceeded.

Chart of the week (29 2024)

Ukraine is the primary rapeseed supplier to the EU

At just under 5.7 million tonnes, EU-27 rapeseed imports from non-EU countries fell well short of the previous year's volume of 7.5 million tonnes, representing a 24 per cent decrease.

EU rapeseed imports from non-EU countries declined sharply compared to the previous year. Two trading partners stood out in terms of origins: Ukraine and Australia. Also, the flow of goods changed significantly, with imports from Ukraine increasing around 6 per cent to just under 3.2 million tonnes, while deliveries from Australia decreased around 43 per cent to just less than 1.9 million tonnes. The decline in imports from Down Under was due to a smaller rapeseed harvest, which was down approximately 1.2 million tonnes compared to the 2022/2023 marketing year, to 4.9 million tonnes, severly curtailing export potential.

EU rapeseed imports from Moldova tripled to just under 250,000 tonnes. There is reason to assume that a major portion originated from Ukraine. On the other hand, Canada delivered barely 100,000 tonnes, representing a 59 per cent decline from 2022/23. The drop was due to increasing domestic consumption and exports to the US - in both cases for biofuel production. Notably, the 2023 Canadian harvest was even larger than the previous year's, at 18.3 million tonnes.

Chart of the week (28 2024)

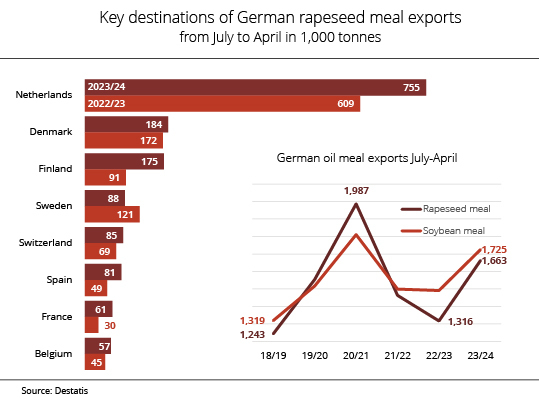

German rapeseed meal exports up 26 per cent on the previous year - UFOP: rapeseed oil-based biodiesel is a key element of the European protein strategy

German rapeseed meal exports have exceeded the previous year's volume significantly. Main buyers, such as Denmark, the Netherlands or Finland, raised their imports considerably, whereas Sweden ordered less.

From July 2023 to April 2024, Germany exported a total of just less than 1.7 million tonnes of rapeseed meal. This was up about 26 per cent on the same period a year earlier. According to Agrarmarkt Informations-Gesellschaft (mbH), this is the largest quantity exported in three years. German rapeseed meal is primarily delivered to EU member states, which received round 1.5 million tonnes in the period stated. The Netherlands imported the largest quantity at 755,000 tonnes, representing an increase of 24 per cent. Denmark, the second largest trading partner, raised its imports from Germany 7 per cent to 184,000 tonnes. Deliveries to Finland are noteworthy as they doubled from just under 91.000 tonnes during last year's period to 175,000 tonnes. Spain and France also sourced more rapeseed meal from Germany. In contrast, deliveries to Sweden dropped 14 per cent to 88,000 tonnes, according to information published by the German Federal Statistical Office. Switzerland remained the most important recipient outside the European Community, boosting its imports just less than 23 per cent to a record 85,000 tonnes.